Students can Download 1st PUC Business Studies Previous Year Question Paper March 2019 (Noth), Karnataka 1st PUC Business Studies Model Question Papers with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 1st PUC Business Studies Previous Year Question Paper March 2019 (North)

Time: 3.15 Hours

Max Marks: 100

Instructions to candidates:

- Write the serial number of questions properly as given in the question paper while answering

- Write the correct and complete answers.

Section – A

I. Answer any ten of following questions in a word or a sentence each. While answering Multiple Choice Questions, write the serial number / alphabet of the correct choice and write the answer corresponding to it. Each question carries one mark: ( 10 × 1 = 10 )

Question 1.

Which of the following cannot he classified as an objective of business.

(a) Investment

(b) Productivity

(c) Innovation

(d) Profit earning

Answer:

(a) Investment.

Question 2.

Who is the Head of the Hindu undivided family business?

Answer:

Karta.

Question 3.

Give an example for statutory corporation.

Answer:

LIC, RBI.

Question 4.

Name any one type of Bank account.

Answer:

Savings Bank Account.

![]()

Question 5.

E-Commerce does not include.

(a) A business interactions with its suppliers

(b) A business interactions with its customers

(c) Interactions among the various departments within business

(d) Interactions among the geographically dispersed units of the business.

Answer:

(d) Interactions among the geographically dispersed units of the business.

Question 6.

How is land pollution caused?

Answer:

Dumping of toxic waste.

Question 7.

Minimum number of members of form private company is

(a) 2 (b) 3 (c) 5 (d) 7

Answer:

(a) 2

Question 8.

For which purpose fixed capital needed?

Answer:

For purchase of fixed assets.

Question 9.

Expand: NABARD.

Answer:

National Bank for Agriculture and Rural Development.

Question 10.

What is wholesale trade?

Answer:

Buying and selling of goods in large scale called wholesale trade.

Question 11.

When two or more firms come together to create a new business entry that is legally separate and distinct from its parents, it is known as

(a) Contract manufacturing

(b) Franchising

(c) Joint ventures

(d) Licensing

Answer:

(c) Joint ventures.

![]()

Question 12.

Name any one document of Export business.

Answer:

Export invoice or shipping bill.

Section – B

II. Answer any ten of the following questions in two or three sentences each. Each question carries 2 marks. ( 10 × 2 = 20 )

Question 13.

What is business?

Answer:

Business is an economic activity involving the production and sale of goods and services undertaken with a motive of earning profit by satisfying human needs is society.

Question 14.

Who is active partner?

Answer:

The partners who actively participate in the day-to-day operations of the business are known as active or working partners.

Question 15.

State any two merits of Departmental Undertakings.

Answer:

Departmental undertakings have certain advantages which are as follows:

- These undertakings facilitate the Parliament to exercise effective control over their operations.

- These ensure a high degree of public accountability.

- The revenue earned by the enterprise goes directly to the treasury and hence is a source of income for the government.

- Where national security is concerned, this form is most suitable since it is under the direct control and supervision of the concerned Ministry.

![]()

Question 16.

Name the two facilities available under Postal services.

Answer:

- Financial facilities.

- Mail facilities.

Question 17.

Give the meaning of Outsourcing.

Answer:

Outsourcing is the process by which a company contracts another company to provide particular services.

Question 18.

What is Social Responsibilities of Business?

Answer:

Various activities which provides for the welfare of the society along with the earning of profit for the firm are termed as ‘Social Responsibility of Business’.

Question 19.

Give the meaning of Prospectus.

Answer:

According to Section 2 (70) of Companies Act 2013 a prospectus has been defined as “any document described or issued as a prospectus and includes any notice, circular, advertisement or other document, inviting deposits from the public or inviting offers from the public for the subscription or purchase of shares or debentures of a company or body corporate”.

![]()

Question 20.

Mention any two international Sources of business finance.

Answer:

- Global depository receipts.

- American depository receipts.

Question 21.

Write the meaning of village industries.

Answer:

Village industry has been defined as any industry located in a rural area which produces any goods, renders any service with or without the use of power arid in which the fixed capital investment per head or artisan or worker does not exceed Rs. 50,000.

Question 22.

State any two demerits of Departmental stores.

Answer:

- Limited selection of goods

- Lack of initiative.

Question 23.

What is international business?

Answer:

According to Michael R. Czinkota, “International business consists of transactions that are devised and carried out across national borders to satisfy the objectives of the individuals, companies and organisations. These transactions take on various forms which are often interrelated”.

![]()

Question 24.

Write any two objectives of W.T.O.

- To ensure reduction of tariffs and other trade barriers imposed by different countries.

- To facilitate the optimal use of the world’s resources for sustainable development.

Section – C

III. Answer any seven of the following questions in 10-12 sentences. Each question carries 4 marks. ( 7 × 4 = 28 )

Question 25.

What are the various types of Industries? Explain with example.

Answer:

The various types of industries are:

1. Primary industries: Primary industries refer to industries which are concerned with the production of goods mainly with the help of nature. Mining, agriculture, forestry, fishing, etc. are example for primary industries. Primary industries can be classified as:

(a) Genetic industries: Genetic industries refer to those activities which are undertaken for reproducing or multiplying plants and animals with the object of making profit from their sales. Example: Nurseries raising seedlings and plants, cattle breeding, poultry farming, etc.

(b) Extractive industries: Extractive industries refer to those activities which are concerned with the extraction or production of wealth from soil, air, water or from beneath the surface of the earth. Example: Agriculture, mining, fishing, forestry, hunting, fruit gathering, etc.

2. Secondary industries: Secondary industries refer to industries where human labour plays a more important role than nature. Secondary industries can be classified into:

(a) Manufacturing industries: Manufacturing industries refer to activities concerned with the conversion of raw materials or semi-finished goods into finished goods.

Example: Conversion of raw cotton into cotton textiles; conversion of raw jute into jute products; production of sugar from sugarcane, etc. Manufacturing industries may be sub-divided into four types. They are:

(i) Analytical industries: Analytical industries refer to those manufacturing industries which produce many types of product by analysing, i.e. separating, the same basic raw materials into different products. Example: In oil refining, the same crude oil is analysed or separated into different products like petrol, diesel oil, kerosene, lubricating oil, etc.

(ii) Synthetic industries: Synthetic industries refer to all those manufacturing industries where various materials are combined together in the manufacturing process to manufacture a new product. Example: Cement industry is a synthetic industry, in the sense that cement is produced by combining many materials, such as gypsum, coal, etc.

(iii) Processing industries: Processing industries refer to those manufacturing industries where different component processed through Trent processes into finished product. Paper industry, textile industry, etc. are the example processing industries.

(iv) Assembling industries: Assembling industries refer to those manufacturing industries where different component parts already manufactured are assembled into final products. Automobile industry is an example for assembling industries.

(b) Construction industries: Construction industries refer to those activities which are concerned with the creation of infrastructure necessary for economic development. In other words, they refer to those which are concerned with the construction of buildings, roads, bridges, railway lines, dams canals, etc.

3. Tertiary industries: Tertiary industries refer to industries which provide support services to primary and secondary industries and also to activities relating to trade. These days, services also are regarded as industries, and are called tertiary industries. These industries are regarded as part of commerce, i.e. as auxiliaries to trade.

Question 26.

State any four features of government companies.

Answer:

- Formation: These companies are formed by the Indian Companies Act, 1956 or 2013.

- Ownership: The ownership of these companies is in the hands of the government. In total capital major portion of the capital not less than 51% is contributed by government.

- Separate entity: They have separate legal entity, apart from the government.

- Government audit: These companies are exempted from the accounting and audit rules and procedures. An auditor is appointed by the central government.

- Financial autonomy: The government company obtains its funds from government shareholdings and other private shareholders. It is also permitted to raise funds from the capital market.

![]()

Question 27.

Briefly explain any four functions of warehousing.

Answer:

Usually, goods are not sold or consumed immediately after production. They are held in stock to be available as and when required. Special arrangement must be made for storage of goods to prevent loss or damage. Warehousing helps business firms to overcome the problem of storage and facilitates the availability of goods when needed.

Functions of Warehousing :

1. Consolidation: The warehouse receives and consolidates materials/goods from different production plants and dispatches the same to a particular customer on a single transportation shipment.

2. Break the Bulk: The warehouse divides the bulk quantity of goods received from the production plants into smaller quantities and then transported according to the requirements of clients to their places of business.

3. Stock Piling Goods or Raw Materials which are not required immediately for sale or manufacturing are stored in warehouses to be made available to business depending on customers demand. This type of warehouse is also known as the storehouse of surplus goods.

4. Value Added Services: Provision of value added services such as in transit mixing, packaging and labeling is also a function of modem warehousing.

5. Price Stabilization: Warehousing performs the function of stabilizing prices by adjusting the supply of goods according to demand. Financing warehouse owners provide loans to the owners on security of goods and further supply goods on credit terms to customers. The warehouse keepers issue a receipt when goods are kept in warehouse. This receipt can be used as security to get loans from banks and owners. In this way, it also helps in financing.

Question 28.

Explain any four benefits of e-Business.

Answer: The benefits or importance are:

- Ease formation and lower investment requirements: It is relatively easy to start because legal formalities and capital is less when compared to traditional business.

- Convenience: Electronic commerce enables customers to shop or do other transactions 24 hours a day, all year round, from almost any location.

- Global Reach/Access: Internet is truly without boundaries. On the one hand, it allows the seller an access to the global market; on the other hand, it affords to the buyer a freedom to choose products from almost any part of the world.

- Cost Effective: E-commerce is proved to be highly cost effective for business concerns as it cuts down the cost of marketing, processing, inventory management, customer care, etc. It also reduces the burden of infrastructure required for conducting business.

![]()

Question 29.

Explain the social responsibilities of business towards.

(a) Share holders

(b) Consumers.

Answer:

Social responsibility of business towards shareholders:

- A fair rate of dividend should be regularly paid by the business enterprises to their owners.

- Management techniques should be effective and efficient so that the net present value of the business is maximized.

- Owners should be given the right to participate in the affairs of the enterprise.

- The tendency towards the growth of ‘Oligarchic management’ should he arrested.

- The owners should be given the full information regarding the working of the company. In other words, accurate and comprehensive reports have to be supplied.

- Financial information has to be disclosed and doubts have to be clarified.

- Chairman and directors of the company should be easily accessible to the owner.

Social responsibility of business towards consumer:

- Ensuring availability of products in the right quantity, at the right place and at the right time.

- Maintaining the quality of the goods, increasing the quality to maximum extent so as to complete with any international product.

- Charging reasonable prices to its products.

- Correct weights and measures have to be used.

- The company must provide after sale service for maintenance of goods.

- The business firms should avoid restrictive trade practices and see that full justice is done to the amount that is spent by a consumer.

- Constant investigation and discovery of growing wants of consumers, giving importance for research and development of new products that satisfy their wants.

- Taking all such measures which promote consumer satisfaction, interest and welfare.

Question 30.

Explain briefly any four clauses of Memorandum of Association.

Answer:

1. Name Clause: It contains the name by which the company will be established. The approval of the proposed name is taken in advance from the Registrar of the companies.

2. Objects Clause: It contains detailed description of the objects and rights of the company, for which it is being established. A company can undertake only those activities which are mentioned in the objects clause of its memorandum.

3. Capital Clause: It contains the proposed authorized capital of the company. It gives the classification of the authorized capital into various types of shares, (like equity and preference shares) with their numbers and nominal value. A company is not allowed to raise more capital than the amount mentioned as its authorized capital. However, the company is permitted to alter this clause as per the guidelines prescribed by the Companies Act.

4. Liability Clause: It contains financial limit up to which the shareholders are liable to pay off to the outsiders on the event of the company being dissolved or closed down.

![]()

Question 31.

Explain any four types of debentures.

Answer:

1. Secured and Unsecured: Secured debentures are such which create a charge on the assets of the company, thereby mortgaging the assets of the company, in the assets of the company.

2. Registered and Bearer: Registered debentures are those which are duly recorded in the register of debenture holders maintained by the company. These can be transferred only through a regular instrument of transfer. In contrast, the debentures which are transferable by mere deliver are called bearer debentures.

3. Convertible and non-convertible: Convertible debentures are those debentures that can be converted into equity shares after the expiry of a specified period. On the other hand, non-convertible debentures are those such cannot be converted into equity shares.

4. First and second: Debentures that are repaid before other debentures are could are known as first debentures. The second debentures are those which are paid after the first debenture have been paid back

Question 32.

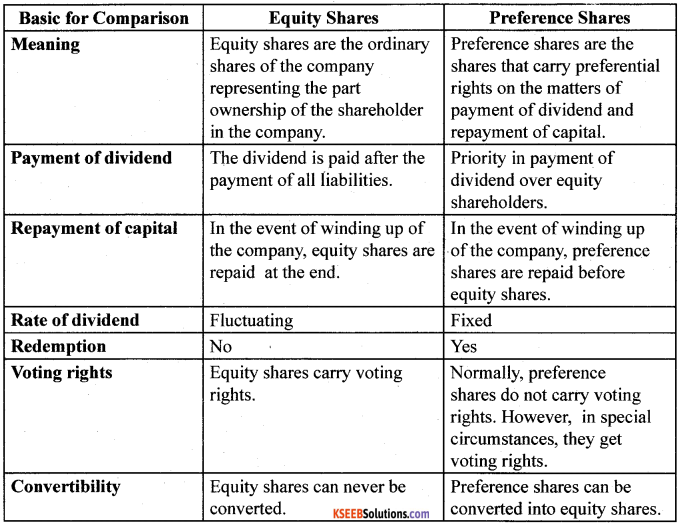

Write any four differences between Equity shares and Preference shares.

Answer:

![]()

Question 33.

Briefly explain the common incentives offered to attract small industries in rural areas by the government.

Answer:

Some of the common incentives provided by the Government for industries in backward and hills areas are as follows:

- Land: Every state offers developed plots for setting up of industries. The terms and conditions may Some states don’t charge rent in the initial years, while some allow payment in installments.

- Power: It is supplied at a concessional rate of 50%, while some states exempt such units from payment in the initial years.

- Water: It is supplied on no-profit, no-loss basis or with 50% concession or exemption from water charges for a period of 5 years. Sales Tax: In all union territories, industries are exempted from sales tax, while some states extend exemption for 5 years period.

- Octroi: Most states have abolished octroi.

- Raw materials: Units located in backward areas get preferential treatment in the matter of allotment of scarce raw materials like cement, iron and steel, etc.

- Finance: Subsidy of 10-15% is given for building capital assets. Loans are also offered at concessional rates.

- Industrial estates: Some states encourage setting up of industrial estates in backward areas.

- Tax holiday: Exemption from paying taxes for 5 or 10 years is given to industries established in backward, hilly and tribal areas.

Question 34.

Briefly explain the limitations of super markets.

Answer:

Limitations:

- No credit: Super markets sell their products on cash basis only. No credit facilities are made available to the buyers. This restricts the purchasing power of buyers from such markets.

- No personal attention: Super markets work on the principle of self-service. The customers, therefore, don’t get any personal attention. As a result, such commodities that require personal attention by sales people cannot be handled effectively in super markets.

- Mishandling of goods: Some customers handle the goods kept in the shelf carelessly. This may raise costs in super markets.

- High overhead expenses: Super market incurs high overhead expenses. As a result these have not been able to create low price appeal among the customers.

- Huge capital requirement: Establishing and running a super market requires huge investment. The turnover of a store should be high so that the overheads are kept under reasonable level. This can be possible in bigger towns but not in small towns.

Section – D

IV. Answer any four of the following questions in 20-25 sentences each. Each question carries 8 marks. ( 4 × 8 = 32 )

Question 35.

Explain the merits and demerits of sole proprietorship form of business organisation.

Answer:

Merits:

- Ease of formation and closure: Like sole proprietorship, the partnership business can be formed easily without any legal formalities.

- More funds: In a partnership, the capital is contributed by a number of partners. This makes it possible to raise larger amount of funds as compared to a sole proprietor and undertake additional operations when needed.

- Sharing risks: The risks involved in running a partnership firm are shared by all the partners. This reduces the anxiety, burden and stress on individual partners.

- Secrecy: A partnership firm is not legally required to publish its accounts and submit its reports. Hence it is able to maintain confidentiality of information relating to its operations.

Demerits:

- Limited capital: Since the total number of partners cannot exceed 20, the capital to be raised is always limited. It may not be possible to start a very large business in partnership form.

- Lack of continuity of business: A partnership firm comes to an end in the event of death, lunacy or retirement of any partner. Even otherwise, it can discontinue its business at the partners. At any time, they may take a decision to end their relationship.

- Lack of public confidence: There is no governmental supervision over the affairs of the business of a partnership and publishing accounts is also not necessary. Hence, public may not have full confidence in them.

- Unlimited liability: The liability of each partner is not limited to the amount invested but his private property is also liable to pay the business obligations.

![]()

Question 36.

Explain the types of Co-operative societies.

Answer:

Types of co-operative society:

1. Consumer’s cooperative societies:

- The consumer cooperative societies are formed to protect the interests of consumers.

- The members comprise of consumers desirous of obtaining good quality products at reasonable prices.

- The society aims at eliminating middlemen to achieve economy in operations.

- It purchases goods in bulk directly from the wholesalers and sells goods to the members directly.

- Profits, if any, are distributed on the basis of either their capital contributions to the society or purchases made by individual members.

2. Producer’s cooperative societies:

- These societies are set up to protect the interest of small producers.

- The members comprise of producers desirous of procuring inputs for production of goods to meet the demand of consumers.

- The society aims to fight against the big capitalists and enhance the bargaining power of the small producers.

- It supplies raw materials, equipment and other inputs to the members and also buys their output for sale.

- Profits among the members are generally distributed on the basis of their contributions to the total pool of goods produced or sold by the society.

3. Marketing cooperative societies:

- Such societies are established to help small process in selling their products.

- The members consist of producers who wish to obtain reasonable prices for their output.

- The society aims to eliminate middlemen and improve competitive position of its members by securing a favorable market for the products.

- It pools the output of individual members and performs marketing functions like transportation, warehousing, packaging, etc.

- Profits are distributed according to each member’s contribution to the pool of output.

4. Farmer’s cooperative societies:

- These societies are established to protect the interests of farmers by providing better inputs at a reasonable cost.

- The members comprise of farmers who wish to jointly take up farming activities.

- The aim is to gain the benefits of large scale farming and increase the productivity.

- Such societies provide better quality seeds, fertilizers, machinery and other modern techniques.

5. Credit cooperative societies:

- Credit cooperative societies are established for providing easy credit on reasonable terms to the members.

- The members comprise of persons who seek financial help in the form of loans.

- The aim of such societies is to protect the members from the exploitation of lenders who charge high rates of interest on loans.

- Such societies provide loans to members out of the amounts collected as capital and deposits from the members and charge low rates of interest.

6. Cooperative housing societies:

- To help people with limited income to construct houses at reasonable costs.

- The members of these societies consist procuring residential accommodation at lower costs.

- The aim is to solve the housing problems of the members by constructing houses and giving the option of paying in installments.

- These societies construct flats or provide plots to members on which the members themselves can construct the houses as per their choice.

Question 37.

Explain the principles of insurance.

Answer:

1. Principle of utmost good faith: According to this principle, the insurance contract must be signed by both parties (i.e. insurer and insured) in an absolute good faith or belief or trust. The person getting insured must willingly disclose and surrender to the insurer his complete true information regarding the subject matter of insurance.

Example: If any person has taken a life insurance policy by hiding the fact that he is a cancer patient and later on if he dies because of cancer then Insurance Company can refuse to pay the compensation as the fact was hidden by the insured.

2. Principle of insurable interest: As per this principle, the insured must have insurable interest in the subject matter of insurance. It means insured should gain by the existence or safety and lose by the destruction of the subject matter of insurance.

Example: If a person has taken the loan against the security of a factory premises then the lender can take fire insurance policy of that factory without being the owner of the factory because he has financial interest in the factory premises.

3. Principle of indemnity: According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. Insurance contract is not made for making profit else its sole purpose is to give compensation in case of any damage or loss.

Example: A person insured a car for 5 lakhs against damage or an accident case. Due to accident he suffered a loss of 3 lakhs. then the insurance company will compensate him 3 lakhs not only the policy amount i.e., 5 lakhs as the purpose behind it is to compensate not to make profit.

4. Principle of contribution: According to this principle, the insured can claim the compensation only to the extent of actual loss either from all insurers in a proportion or from any one insurer.

Example: A person gets his house insured against fire for 50,000 with insurer A and for 25,000 with insurer B. A loss of 37,500 occurred. Then A is liable to pay 25,000 and B is liable to pay 12,500.

5. Principle of subrogation: According to the principle of subrogation, when the insured is compensated for the losses due to damage to his insured property, then the ownership right of such property shifts to the insurer.

Example: If a person receives Rs. 1 lakh for his or her damaged stock, then the ownership of the stock will be transferred to the insurance company and the person will hold no control over the stock.

6. Principle of mitigation of loss: According to the Principle of mitigation of loss, insured must always try his level best to minimize the loss of his insured property, in case of uncertain events like a fire outbreak or blast, etc. The insured must not neglect and behave irresponsibly during such events just because the property is insured.

Example: If a person has insured his house against fire, then, in case of fire, he or she should take all possible measures to minimise the damage to the property exactly in the manner he or she would have done in absence of the insurance,

7. Principle of Causa Proxima: Principle of Causa Proxrna (a Latin phrase), or in simple English words, the Principle of Proximate (i.e. Nearest) Cause, means when a loss is caused by more than one causes, the proximate or the nearest cause should be taken into consideration to decide the liability of the insurer.

Example: If an individual suffers a loss in A fire accent, then this should already he a part of the contract in order for this person to claim the insurance amount.

![]()

Question 38.

Discuss the factor that affect while making the decision for the choice of an appropriate source of funds by a business organisation.

Answer:

1. Cost: There are two types of costs, the cost of procurement of funds and cost of utilizing the funds. Both these costs should be taken into account while deciding about the source of funds that will be used by an organisation.

2. Financial strength and stability of operations: The financial strength of a business is also a key determinant. In the choice of source of funds business should be in a sound financial position so as to be able to repay the principal amount and interest on the borrowed amount.

3. Form of organisation and legal status: The form of business organisation and status influences the choice of a source for raising money.

4. Purpose and time period: Business should plan according to the time period for which the funds are required. A short-term need for example can be met through borrowing funds at low rate of interest through trade credit, commercial paper, etc. For long term finance, sources such as issue of shares and debentures are more appropriate.

5. Risk profile: Business should evaluate each of the sources of finance in terms of the risk involved. For example, there is a least risk in equity as the share capital has to be repaid only at the time of winding up and dividends need not be paid if no profits are available.

6. Control: A particular source of fund may affect the control and power of the owners on the management of a firm. Issue of equity shares may mean dilution of the control.

7. Effect on credit worthiness: The dependence of business on certain sources may affect its credit worthiness in the market.

8. Flexibility and ease: Another aspect affecting the choice of a source of finance is the flexibility and ease of obtaining funds. Restrictive provisions, detailed investigation and documentation in case of borrowings from banks and financial institutions.

9. Tax benefits: Various sources may also be weighed ¡n terms of their tax benefits. For example. while the dividend on preference shares is not tax deductible, interest paid on debentures and loan is tax deductible and may, therefore, be preferred by organisations seeking tax advantage.

Question 39.

Explain the services of retailers to wholesalers and consumers.

Answer:

Services of retailers towards customer are:

- Regular availability of products: The most important service of a retailer to consumer is to maintain regular availability of various products produced by different manufacturers.

- New products information: By arranging for effective display of products and through their personal selling efforts, retailers provide important information about the arrival, special features, etc. of new products to the customers.

- Convenience in buying: Retailers generally buy goods in large quantities and sell these in small quantities, according to the requirements of their customers.

- Wide selection: Retailers generally keep stock of a variety of products of different manufacturers. This enables the consumers to make their choice out of a wide selection of goods.

![]()

Question 40.

What are the steps to be followed in import procedure?

Answer:

1. Trade enquiry: The importing firm approaches the export firms with the help of trade enquiry they collecting information about their export prices and terms of exports. After receiving a trade enquiry, the exporter will prepare a quotation called proforma invoice.

2. Procurement of import licence: There are certain goods that can be imported freely, while others need licensing. The importer needs to consult the Export Import (EXIM) policy in force to know whether the goods that he or she wants to import are subject to import licensing.

3. Obtaining foreign exchange: Since the supplier in the context of an import transaction resides in a foreign country, he/she demands payment in a foreign currency. Payment in foreign currency involves exchange of Indian currency into foreign currency.

4. Placing order or indent: After obtaining the import licence, the importer places an import order or indent with the exporter for supply of the specified products. The import order contains information about the price, quantity size, grade and quality of goods ordered and the instructions relating to packing, shipping, ports of shipment and destination etc.

5. Arranging for finance: The importer should make arrangements in advance to pay to the exporter on arrival of goods at the port. Advanced planning for financing imports is necessary so as to avoid huge demur rages (i.e.. penalties) on the imported goods lying uncleared at the port for want of payments.

6. Obtaining letter of credit: If the payment terms agreed between the importer and the overseas supplier is a letter of credit. then the importer should obtain the letter of credit from its bank and forward it to the overseas supplier.

7. Receipt of shipment advice: After loading the goods on the vessel, the overseas supplier dispatches the shipment advice to the importer. A shipment advice contains information about the shipment of goods.

8. Retirement of import documents: Having shipped the goods, the overseas supplier prepares a set of necessary documents as per the terms of contract and letter of credit

Section – E

V. Answer any two of the following questions: ( 2 × 5 = 10 )

Question 41.

As the owner of a business unit what risks you may face in running it?

Answer:

The risk faced by owner while running a business unit are:

- Market information risk

- Consumer taste and preferences risk

- Government policy risk

- Capital risk

- Operational risk.

Question 42.

As a businessman having concern for environment protection, suggest any five steps which can be taken by you for environment protection.

Answer:

Five measures to control environment pollution are:

- Definite commitment by top management of enterprise to create, maintain and develop work culture for environmental protection and pollution prevention.

- Complying with laws and regulations enacted by the government for prevention of pollution.

- Participation in government programmes relating to management of hazardous substance, plantation of trees and checking deforestation.

- Ensuring that commitment to environmental protection is shared throughout the enterprise by all divisions and employees.

- Arranging educational workshop and training materials to share technical information and experience with suppliers, dealers and customers to get them actively involved in pollution control programmes.

![]()

Question 43.

As an aspirant of doing international business what different modes of entry into international business do you find?

Answer:

Different modes of entry into international business are:

- Export and import

- Joint venture

- Licensing and franchising

- Contract manufacturing

- Wholly owned subsidiaries.