Karnataka 2nd PUC Economics Important Questions Chapter 2 National Income Accounting

Very Short Answer Type Questions

Question 1.

Give the meaning of National income?

Answer:

The money value of all final goods and services produced in a country in a year.

Question 2.

What are final goods?

Answer:

Goods which are purchased for final use are final goods.

Ex: T.V, wrist watch etc.,

Question 3.

What are intermediate goods?

Answer:

Goods which are produced by some producer and used by some other producer as material input are called intermediate goods. Ex: Wood used to produce fiirniture etc

Question 4.

What is deducted from GDP to arrive at NDP?

Answer:

Depreciation cost is deducted from GDP to arrive at NDP

Question 5.

Give the meaning of per capita in come?

Answer:

It refers to the average income of the people of a country.

Question 6.

What is economic welfare?

Answer:

Economic welfare means the satisfaction derived by the people from consumption of goods and services.

Question 7.

What are externalities?

Answer:

Externalities are unintentional consequences of an economic action of a person or firm that accrues to another person or firm.

![]()

Question 8.

What is inventory?

Answer:

Output which could not be sold in the same year is known as inventory.

Question 9.

What are Transfer Payments?

Answer:

Payments made by govt such as old age pension, widow pension, scholarship etc are called transfer payment.

Question 10.

What do you mean by Depreciation cost?

Answer:

The value of capital goods should be deducted from gross investment to arrive at net investment. Such deduction is called depreciation cost.

Question 11.

Between net investment and capital which is a storck and which is a flow.

Answer:

Stock is net investment Flow is capital

Question 12.

Name the factors of production.

Answer:

Land, Labour, capital and organisation

Short Answer Type Questions

Question 1.

Distinguish between consumer goods and capital goods. Give examples.

Answer:

Consumer goods

- Goods which are purchased for consumption

- Ex:-Food, drinks, etc.,

Capital goods

- Goods which are used in the production of some other goods.

- Ex: factories, machinery, etc.,

![]()

Question 2.

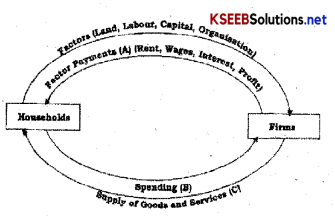

Give the meaning of circular flow of income.

Answer:

The process whereby the national income and expenditure of an economy flows in a circular manner continuously between different sectors.

Question 3.

Classify the following into stocks and flows.

Answer:

Bank deposits, salary, wealth, food grain stock, exports, imports, foreign exchange reserves, national income Stocks are-Bank deposits, food grain stock, foreign exchange reserves.

Flow-Salary, wealth, exports, imports, and national income.

Question 4.

Name the factor payments.

Answer:

- Land-Rent

- Labour-wages

- Capital-Interest

- Organisation-Profit

Question 5.

How does GNP differ from GDP?

Answer:

GNP:

- If is the aggregate money value of all final goods and services produced by country in a year including net income from abroad.

- It is wider concept

GDP:

- It is the aggregate value of final goods and services produces within a country in a year

- It is a narrow concept

Question 6.

Distinguish between nominal national income and real national income

Answer:

Nominal national income:

- The national income figures are expressed in the current year prices

- It does not give a clear picture of the economy

Real Nation Income:

- The national income is expressed in terms of base year prices.

- It gives clear picture of the economic conditions.

![]()

Question 7.

Name the methods of measuring national income.

Answer:

There are 3 methods of measuring national income:-

- Income method

- Expenditure method and

- Product method

Question 8.

What is the opinion of the IMF with regard to income from foreign firms?

Answer:

The IMF of the opinion that the income of a foreign firm should be included in the income of the country where it is located. However, profits earned by foreign firms should be credited to the parent country.

Question 9.

Nishanth is a lecturer in a college. He teaches his children at home. Are both teachings included in national income measurement? If not, why?

Answer:

The Nishanth that he teaches his children at home will not be included in National income. Because it comes under unaccountable and unofficial service clearly.

Question 10.

What are externalities? Explain with an example.

Answer:

Externalities are unintentional consequences of the economic activity of a person or firm that accrues to another person or firm.

For example, The construction of a road is a positive externality because it increases the value of long along the road

Heavy traffic on the road creates the problem of pollution. This is a negative externality

![]()

Question 11.

Name any 4 reasons why GDP is not a true indicator of welfare?

Answer:

- Inequality in the distribution of income

- Non-monetary exchanges

- Harmful goods

- Externalities

- Manner of Production

Question 12.

Distinguish between stock and flow Stock:

Answer:

Stock refers to a quantity existing at a particular point of time

It is a static concept Flow:

Flows are additions made to the stock It is a dynamic concept.

Question 13.

Mention any 4 precautions that should be taken while estimating national income by-product method.

Answer:

- Avoid double counting

- The value of goods used for self-consumption should be added by guesswork.

- Depreciation cost should be deducted

- The value of second hand goods should be ignored.

Long Answer Type Questions

Question 1.

Describe the Circular Flow of income in a simple economy.

Answer:

There are innumerable producers and households in an economy. A simple economy is a closed economy. A simple economy is a closed economy in which there is no government or external trade or savings.

A simple two-sector model economy based on the following assumptions.

- There are only two sectors in the economy. They are the household sector and firms.

- Households are the owners of factors of production and firms buy these factors.

- Households receive income by selling factor services and spend their entire income on consumption.

- Finns sell their entire production to the households. There are no inventories.

- The economy is a closed economy, without govt.

- This circular flow of income can be explained with the help of a chart.

In the chart showing 2 types of the circular flow of income. They are:

- Real Flow of incocme

- Money Flow of income

Real Flow of income:

It refers to the rendering of factor services by households to firms, and the firms produce goods and services by employing factor services.

Money flow of income:

All payments by the firms to the households for factor services.

Thus production is a continuous activity because human wants are unlimited. This makes the flow of income circular.

![]()

Question 2.

Explain macro economic identities GDP,NDP,GNP and NNP.

Answer:

(a) GDP (Gross Domestic Product): GDP is the aggregate value of final goods and services produced within the country during a year.

GDP = C + I + G + net X

Where,

C = Gross final consumption expenditure

I = Gross private sector investment

G = Governments consumption and investment expenditure

Net X = net exports

(b) NDP (Net Domestic Product):

It is the aggregate money value of all final goods and services produced within the country less depreciation cost. When depreciation allowances is substracted from GDP we get NDP.

Hence, NDP = C + I + G + net X-DC or

NDP = GDP – Depreciation cost.

(c) GNP (Gross National Product):

It is the aggregate money value of all final goods and services produced by a country in a year including net income from abroad. GNP = C + I + G + (X – M) + (R – P)

(R – P) = Income received from abroad (R) and income paid to foreigners (P)

(d) NNP (Net National Product):

It is the aggregate market value of the final goods and services produced in a country in a year after deducting depreciation charges provided for the replacement of worn-out capital assets.

NNP = GNP – Depreciation

Question 3.

Write a note on Nominal national income, Real national income.

Answer:

Nominal National Income:

When the national income figures are expressed in the prices in current year in which it is calculated it is called nominal national income.

Nominal national income does not give a clear picture of the condition of the economy. PThe actual production of goods and services might have been less in the current year.

Real National Income:

When national income is expressed interms of base year prices or constant prices, is called real national income. The price level for that year is assued to be 100.

The following formula is used for calculating real national income.

Real national income = National income for the current year × base

\(\frac{\text { year price index }}{\text { Current year price index }}\) × 100

![]()

Question 4.

Describe any five problems in the measurement of national income.

Answer:

National income accounting is not an easy task. A number of difficulties arise in the measurement of national income accurately.

Some of these difficulties are:

Transfer Payments: Payments made by government such as old age pension, widow pension. Unemployment benefit etc, are called transfer payments. These are a part of individual income as well as apart of govt expenditure. Therefore, these payments are ignored from national income.

Treatment of government services: Govt provides various public services like defence, administration, justice etc. It is difficult to measure the value of such services.

Unpaid services:

Unpaid services performend by house wives, charitable institutions, NSS students etc are not included in national income this leads to under estimation of nationall income.

Income from illegal activities:

Income from illegal activities such as

smuggling, gambling, illicit brewing of liquor, black marketing etc. Is not included in national income. This reduces the actual value of .national income.

Changing general price level:

Change in price level also makes accurate estimation of national income difficult. This is because when general prices rise, the national income in money terms increases even though the national output remains constant.

Question 5.

Describe the relationship between national income and welfare.

Answer:

The ultimate objective of economic policy is to promote the welfare of the people welfare is satisfaction or state of wellbeing.

Prof.A.C.Pigou defines economic welfare as “that part of general welfare that can be brought directly or indirectly into relation with measuring rod of money.” Economic welfare is the satisfaction of utility derived by an individual from the use of economic goods and services.

According to AC. Pigou, Alfred Marshall and J.R.Hicks, national income and national welfare are positively correlated. An increase in national income causes an improvement in economic welfare if it is equally distributed among the people. If GDP increases, people get more income. This enables them to buy more goods and services and increase their welfare therefore, national income is treated as the indicator of the welfare of the people. But this may not be true always.

National income is not a relaiable index of economic welfare for certain reasons.

- Inequality in the distribution of income

- Non-monetary exchanges

- Harmful goods

- Manner of production

- Extemaltites

Considering all these points we may conclude that GDP is not barometer economic welfare it is not only a rough indicator inspite ofthese limitations national income occupies a significant place in the formulation of economic policy and comparing the level of economic growth in different countries.

Question 6.

Analyze why GDP is not a barometer of economic welfare but only a rough indicator.

Answer:

National income is not a reliable index of economic welfare for certain reasons.

Inequality in the distribution of income:

An increase in national income inequalities in the distribution of income may occur. That is increased GDP may have increased the income of the small minority but the majority may have remained poor. In this case, welfare of the majority decreases even though the GDP increases.

Non-monetary exchanges:

There are many activities in an economy which are not evaluated in monetary terms. For instance the services of house wives, NGO’s NSS -students etc are not accounted for the national income. .

Harmful goods:

National income does not consider whether the goods and services produced are useful to the people. For example:- Production of cigarettes, liquor, drugs etc is injurious to health but decreases the welfare of the people.

Manner of production:

If more goods are produced by polluting the environment, or by child labour then economic welfare cannot increase.

Externalities:

Externalities are unintentional consequences of an economic action of a person that accrues to another person or firm. These consequences may good or bad positive externalities increase welfare and negative externalities decrease welfare.

Considering all these points we may conclude that GDP is not barometer of economic welfare. It is only a rough indicator.

![]()

Question 7.

Discuss the difficulties in the measurement of national income.

Answer:

National income accounting is not an easy task. A number of difficulties arise in the measurement of national income accurately.

Some of these difficulties are:

Transfer payments:

Payments made by government such as old age pension, widow pension. Unemployment benefit etc are calledtransfer payments. These are a part of individual income as well as a part of govt expenditure. Therefore, these payments are ignored from national income.

Treatment of government services: Govt provides various public services like defence, administration, justice etc. It is difficult to measure the value of such services.

Unpaid services:

Unpaid services performed by house wives, charitable institutions, NSS students etc are not included in national income this leads to under estimation of national income.

Income from illegal activities:

Income from illegal activities such as smuggling, gambling, illicit brewing of liquor, black marketing etc. It is not included in national income. This reduces the actual value ofnational income.

Changing general price level:

Change in price level also makes accurate estimation ofnational income difficult. This is because when general prices rise, the national income in money terms increases even though

the national output remains the same. Similarly, if prices fall in national income in money terms decreases even though the national output remains constant.

Income of foreign firms:

Another problem is with regard to. the income generated by foreign firms. The IMF is of the opinion that the income of a foreign firm should be included in the income of the country where it is located.

Production for self-consumption

Agricultural produce like vegetables, fruits etc., such goods do not enter the market. Farmers do not maintain any accounts regarding the value of such goods. This reduces the actual value of national income.

Problem of double counting:

This is because it is very difficult to distinguish between final goods and intermediate goods. Therefore, the problem of double counting cannot be avoided. This causes over estimation of national income

Lack of reliable data:

In developing countries, most of the people are illiterate and so they do not keep proper records of their and so, they do not keep proper records of their production and sales required for the computation of national income.

Lack of occupational specialization:

Sometimes people have engaged two or more occupations. In rural areas, people earn their income partly from farm ownership and partly from manual work in industries in the off-season. This lack of occupational specialization makes estimation of national income difficult.

Question 8.

Explain the macroeconomic identities of national income.

Answer:

GDP (Gross Domestic Product):

GDP is the aggregate value of final goods and services produced within the country during a year.

GDP = C + I + G + net X

Where C = Gross final consumption expenditure

I = Gross Private Sector investment

G = Governments consumption and investment expenditure

Net X = net exports

NDP (Net Domestic Product): It is the aggregate money value of all final goods and services produced within the country less depreciation cost. When depreciation allowances is substracted from GDP we get NDP

Hence, NDP = C + I + G + net X – DC or NDP = GDP – Depreciation cost.

GNP = C + I + G + (X – M) + (R – P)

(R – P) = Income received from abroad (R) and income paid to foreigners(p)

NNP = (Net National Product)

It is the aggregate market value of the final foods and services produced in a country in a year after deducting depreciation charges provided for the replacement of worn out capital assets

NNP = GNP – Depreciation

Personal Income (PI):

Personal income is that part of national income of a country which is received by people or households.

PI-National income-distributed corporate profits-corporate income taxes-social security contributions+transfer payments.

Personal Disposable Income (PDI): It is the income which is at the disposal of a person to spend as he wishes. Thus, PDI = PI – Personal taxes

Disposable income can either be spent entirely or a part of the income can be saved. Therefore, PDI = Consumption+Savings.

Nominal National Income:

When the national income figures are expressed in the prices of current year.

Real National Income:

When the national income is expressed in terms of base year prices or constant prices The real income is calculated as follows.

Real National Income = National income for the current year X

\(\frac{\text { base year price index }}{\text { Current year price index }}\) × 100

Current year price index

Per capita Income:

Percapita income is the average income of the people of a country:

\(\frac{\text { National income of a country }}{\text { Total population }}\)

Exercises

Question 1.

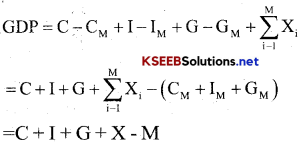

What are the four factors of production and what are the remunerations to each of these called?

Answer:

The four factors of production are:

1. Land- It denotes the natural resources like air, water, soil, etc. The payment that is paid by the firms to acquire these services is called rent.

2. Labour- It refers to the physical and mental effort required to do a work. For example, engineer, manager, worker, etc. The payment made to the labour in exchange of his/her services is called as wage.

3. Capital – Capital is short for goods. These are man-made objects like machinery, equipment, and chemicals that are used in production That’s what differentiates them from consumer goods. For example, capital goods include industrial and commercial buildings, but not private housing. A commercial aircraft is a capital good, but a private jet is not. “ The income earned by owners of capital goods is called interest.”

4. Entrepreneur- It refers to the individual who undertakes the risk to organize the production process. Entrepreneurs are the risk-takers and often are the innovators of new techniques. They receive profit in exchange of their entrepreneurship.

The remunerations paid to the factors of productions are called factor payments or factor incomes. These are the aggregation of rent, wage, interest and profit.

![]()

Question 2.

Why should the aggregate final expenditure of an economy be equal to the aggregate factor payments? Explain.

Answer:

In a two sector economy, consisting of households and firms, the only way in which the households can dispose their income is on the goods and services produced by the firms. The factors of production use their remuneration to purchase goods and services. Thus, the income will come back to the producers in the form of sales revenue. So, there is no difference between the amount that firms distribute in the form of factor payments and consumption expenditure incurred by the households.

The same process continues year after year. However, if there has been any leakage in the form of savings, imports or taxes, then there arises a difference between the aggregate consumption expenditure and aggregate factor payments. In the case of some leakage, the households will spend less than their factor incomes. Consequently, the firms will receive lesser amount in the form of revenue, which will reduce the production level and employment level. This process will continue in every successive round and production and employment levels will continue to drop. Thus, the equality between the aggregate consumption expenditure and the aggregate factor payments is very necessary for the smooth functioning of the economy.

Question 3.

Distinguish between stock and flow. Between net investment and capital, which is a stock and which is a flow? Compare net investment and capital with flow of water into a tank.

Answer:

| Stock | Flow |

| 1. The variables that arc measured at a particular point of time. For example, bank balance as on 1st Oct 2010 is Rs.5000. | 1. The variables that arc measured over an interval of time. For example, incest earned on bank deposits for 1 year, i.e. from 1 Oct 2009 to 30 Sep2010. |

| 2. It has no time dimensions. months, 10 days, etc. | 2. it has time dimensions, like 1 year, 6 |

| 3. Example: capital, bank deposits, water in Flow | 3. Example: capital formation, interest on capital flows in a stream |

Question 4.

What is the difference between planned and unplanned inventory accumulation? Write down the relation between change in inventories and the value-added of a firm.

Answer:

The stock of unsold goods (finished and semi-finished), which a firm carries forward from one year to another year is termed as an inventory.

Inventory accumulation can be planned or unplanned. The planned inventory accumulation refers to the inventory that a firm can anticipate or plan. For example, afirm want to raise its inventory from 1000 to 2000 units of denims and expects sales to be 10000units. Thereby, it produces 10000+1000units, i.e. 11000 units (in order to raise the inventory by 1000 units). If, at the end of the year it is found that the actual sales that got realised were also 10000, then the firm experiences the rise in its inventory from 1000 to 2000units. The closing balance of inventory is calculated in the following manner.

Final Inventory = Opening inventory + Production – Sale = 1000 + 11000-10000 = 2000units of denims In this case the inventory accumulation is equal to the expected accumulation. Hence, this is an example of a planned inventory accumulation.

Unplanned inventory accumulation is an unexpected change in an inventory. There is an unplanned accumulation in an inventory when the actual sales are unexpectedly low or high. For example, let us assume, a firm want to raise inventory from Rs 1000 to 2000 and expects sales to be 10000 and thereby produces 11000 units of denims. If, at the end of the year, the actual sales realized were 9000 units only, which were not anticipated by the firm and therefore the inventory rose by 3000 units.

The unexpected inventory accumulation is calculated as:

Final Inventory = Opening inventory + Production – Sale = 1000 + 11000 – 900

= 3000 UNITS OF DENIMS Hence, this is an example of unexpected inventory accumulation.

The relation between value-added and the change in inventory is shown by the given equation:

Gross value added by a firm = Sales + Change in inventory-Value of intermediate goods

It implies that, as inventory increases, the value added by a firm will also increase, thus confirming the positive relationship between the two.

![]()

Question 5.

Write down the three identities of calculating the GDP of a country by the three methods. Also briefly explain why each of these should give us the same value of GDP.

Answer:

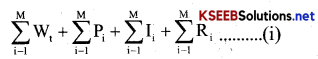

GDP can be calculated by the following three methods:

(a) Income method

GDP = Total payments made to the factors of production

Σ Wt represents total wages and salaries received by i -th households. ΣPi represents total profit received by i-th households.

Σ Ii represents total Income received by i-th households. Σ Wi represents total Rent received by i-th households.

Equation (1) can be simplified as

GDP = W + R + I + P

(a) Value added or product method’

GDP = Sum of gross value added by all

firms in an economy

or GDP = GVA1 + GVA2 +………….. GVAn

GVA1 represents gross value added by the 1st firm

GVA2 – represents gross value added by the 2nd firm and so on GVAn represents gross value added by the nth firm DP = Therefore,

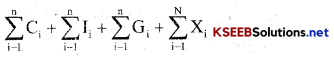

(b) Expenditure method or final consumption method

GDP = Sum total of revenues that firms earn

Or

GDP = Total consumption+Investment + Government Consumption expenditure + Net exports

As households spend some part of their income on imports, some portion of consumption expenditure also comprises of imports, which are denoted by CM similarly, some part of the investment expenditure and government consumption expenditure is spent on the foreign investment goods and imports. These portions of investment and government consumption expenditure are denoted by and GMrespectively. Thus, the final households’ consumption expenditure, investment expenditure, and final government expenditure that are spent on the domestic firms are denoted by, C-CM, I-IM, and G-GMrespectively.

Substituting these values in the above equation

The three methods give the same result for measuring GDP because what is produced in the economy is either consumed or invested. The three methods depict the same picture of an economy from three different angles. While the product method presents the value-added or total production, the income method depicts the income earned by all the factors, lastly, the expenditure method presents the expenditure incurred by all the factors. In the economy, the producer employs four factors Of production to produce final goods and earns revenue by sale, which is equivalent to the total value added by the firm. The firms pay remunerations to the factors, which act as the income of all die factors.

These remunerations are equivalent to the factors’ contributions to the value addition. These factor incomes are then expended on the goods and services, which verifies the equality between file factor „ income and expenditure. Hence, the three methods will always give the same value of GDP.

Question 6.

Define budget deficit and trade deficit. The excess of private investment over saving of a country in a particular year was Rs 2,000 crores. The amount of budget deficit was (-) Rs 1,500 crores. What was the volume of trade deficit of the country?

Answer:

Budget Deficit:

The excess of government expenditure over government income is termed as the budget deficit

Budget Deficit = G – T

Where ‘G’ represents government expenditure

‘T’ represents government income

Trade Deficit:

The trade deficit measures the excess of import expenditure over the export revenue of a country.

Trade Deficit = M – X

Where ‘M’ represents expenditure on imports

‘X’ represents revenue earned by exports

It is given that,

I- S = Rs.2000 crores.

G – T = (-) Rs. 1500 crores.

Therefore,

= 2000 – [1500] = 500 crores

![]()

Question 7.

Suppose the GDP at the market price of a country in a particular year was Rs 1,100 crores. Net Factor Income from abroad was Rs 100 crores. The value of Indirect taxes – Subsidies was Rs 150 crores and National Income was Rs 850 crores. Calculate the aggregate value of depreciation.

Answer:

National Income (NNpc)= Rs.850 crores GDP Mp = Rs. 1100 crores

Net factor income from abroad = Rs. 100 crores

Net indirect taxes = Rs. 150 crores

NNPFC = GDPMP + Net factor income from abroad – Depreciation – Net indirect taxes Putting these values in the formula,

850 = 1100 + 100 – Depreciation -150

850 = 1100 – 50 – Depreciation

850 = 1050 – Depreciation

Depreciation = 1050 – 850 = Rs.200 crores

So, depreciation is Rs.200 crores.

Question 8.

Net National Product at Factor Cost of a particular country in a year is Rs 1,900 crores. There are no interest payments made by the households to the firms/government, or by the firms/government to the households. The Personal Disposable Income of the households is Rs 1,200 crores. The personal income taxes paid by them is Rs 600 crores and the value of retained earnings of the firms and government is valued at Rs 200 crores. What is the value of transfer payments made by the government and firms to the households?

Answer:

NNPFC = Rs. 1900 crores

PDI = Rs. 1200 crores

personal income tax = Rs.600 crores

Value of retained earnings Rs.200 crores

PDI = MNPFC – Value of retained earnings offirms and government+value of transfer payments-personal tax 200 = 1900 – 200 + Value of transfer payments – 600

1200 = 1100+Value of transfer payments Value of transfer payment = 1200 – 1100 = Rs 100 crores.

Question 9.

From the following data, calculate Personal Income and Personal Disposable Income.

| – | Rs (Crore) |

| (a) Net Domestic Product at factor cost | 8,000 |

| (b) Net Factor Income from abroad | 200 |

| (c) Undisbursed Profit | o |

| (d) Corporate Tax | 500 |

| (e) Interest Received by Households | 1,500 |

| (f) Interest Paid by Households | 1,200 |

| (g) Transfer Income | 300 |

| (h) Personal Tax | 500 |

Answer:

Personal Income = NDP + Net factor income from abroad (NFIA) + Transfer Income

– Undistributed profit – corporate tax – Net interest paid by households = Rs.8000 crores

NFIA = Rs.200 crores

Transfer Income = Rs.300 crores

Undistributed profit = Rs. 1,000 crores corporate tax = 500 crores

Net interest paid by households = interest paid-interest recieved

= 1200 – 1500 = (-) Rs.300 crores So, puttingthe values in the above formula

PI – 8000 + 200 + 300-1000 – 500 – (300) = 8000 + 200 + 300 – 1000 – 500 + 300

PI = 7300

So, Personal Income=Rs.7300 crores Personal Disposable income = Personal Income – Personal Payments

= 7300 – 500 = Rs.6800 crores

Question 10.

In a single day Raju, the barber, collects Rs 500 from haircuts; over this day, his equipment depreciates in value by Rs 50. Of the remaining Rs 450, Raju pays sales tax worth Rs 30, takes home Rs 200 and retains Rs 220 for improvement and buying of new equipment. He further pays Rs 20 as income tax from his income. Based on this information, complete Raju’s contribution to the following measures of income

(a) Gross Domestic Product

(b) NNP at market price

(c) NNP at factor cost

(d) Personal income

(e) Personal disposable income.

Answer:

(i) GDPMP= RS.500 [Barber collects from haircut]

(ii) NNPMP = GDP – Depreciation

= 500 – 50

= Rs.450

(iii) = NNPFC – Sales tax =Rs420

(iv) PI = – Retained earnings

= 420 – 220 = Rs.200

(v) PDI = PI – Income tax

= 200-20

= Rs.180

![]()

Question 11.

The value of the nominal GNP of an economy was Rs 2,500 crores in a particular year. The value of GNP of that country during the same year, evaluated at the prices of same base year, was Rs 3,000 crores. Calculate the value of the GNP deflator of the year in percentage terms. Has the price level risen between the base year and the year under consideration?

Answer:

Nominal GNP=Rs.2500

Real GNP = Rs.3000

FNP = \(\frac{\text { Nominal GNP }}{\text { Real GNP }}\) × 100

So,

GNP deflator = \(\frac{2500}{3000}\) × 100

= 83.33%

No, the price level has fallen down by 16.67% [(100-83.33)%].

Question 12.

Write down some of the limitations of using GDP as an index of welfare of a country.

Answer:

Limitations of using GDP as an indicator are as follows:

1. distribution of GDP is ignored.

2. Inflation: GDP does not take into account the level of prices in a country. Because of inflation, the cost of living increases leading to a decrease in the standard of living. The loss of welfare due to this decrease is not taken into consideration by GDP as an index of welfare.

3. Externalities: Increase in the national income is associated with increased levels of pollution, accidents, disasters, shortage and depletion of natural resources, etc. These factors affect human health and lead to ecological degradation. GDP fails to consider the costs or valuations of such factors.

4. Income pattern: GDP disregards the income distribution pattern. The increase in aggregate national income may be a result of the increase in income of a few individuals. Thus, this may lead to false interpretation of social welfare.

5. Welfare: GDP ignores the welfare component as the goods and services produced may or may not add to the welfare to a society. For example, the production of goods, like guns, narcotic drags, high-end luxurious goods increase the monetary value of producti on, but they do not add to the welfare of the majority of the population.