Karnataka 2nd PUC Economics Important Questions Chapter 3 Money and Banking

Very Short Answer Type Questions

Question 1.

What is Barter system?

Answer:

Exchange of goods for goods is called barter system.

Question 2.

What is money?

Money is anything that is commonly accepted as a medium of exchange for goods and services and also acts as a measure of value.

Question 3.

Define money, according to walker.

Answer:

According to F.A.Walker: “Money is what money does”.

Question 4.

Mention two primary functions of money.

Answer:

- Medium of exchange.

- Measure of value.

Question 5.

What is high powered money?

Answer:

The money supplied by RBI and govt of India together provide monetary base. They together are known as high-powered money.

![]()

Question 6.

What is demand for money?

Answer:

Demand for money refers to the total money demanded by the people in the form of cash for various purposes.

Question 7.

Give the meaning of supply of money?

Answer:

Supply of money refers to aggregate stock of money held by the people in the country at a particular point of time.

Question 8.

Expand ATM.

Answer:

ATM-Automated Teller Machine.

Question 9.

What is Narrow money?

Answer:

The money which is fully liquid and available whenever people need is called narrow money.

Question 10.

What is Broad Money?

Answer:

It refers to the money that is held in the form of savings and Net time deposits besides the currency and demand deposits.

Question 11.

What is primary deposit?

Answer:

When a bank accepts cash from the customer and opens a deposit account in his name, it is called primary deposit.

![]()

Question 12.

What is bank rate?

Answer:

Bank rate is the rate of interest charged by the RBI for providing funds of loans to the banking system.

Question 13.

Give the meaning of over draft.

Answer:

Overdraft is a facility provided by a bank to its current account holders.

Question 14.

What is cash Reserve Ratio?

Answer:

It is a certain percentage of bank deposits which commercial banks are required to keep with the RBI in the form of reserves.

Question 15.

What is statutory Liquidity Ratio?

Answer:

It is a certain percentage of bank deposits which commercial banks are required to keep with itself in the form of cash reserves.

![]()

Question 16.

Name the difficulties in the Barter system.

Answer:

- Lack of double coincidence of wants

- Lack of common measure ofvalue

- Lack of Divisibility

- Difficulty in storing wealth

Question 17.

Name the motives of Demand for money according to J.M.Keynes.

Answer:

According to Keynes, the demand for money arises because of the following 3 motives.

- Transaction motive.

- Precautionary motive

- Speculative motive

Question 18.

What are the various types of Deposits?

Answer:

- Current account deposits

- Savings account deposits

- Fixed deposits

- Recurring deposits

Question 19.

Give four objectives of monetary policy.

Answer:

The important objectives of monetary policy are as follows:

- Neutral monetary policy

- Exchange rate stability

- Price stability

- Control of business cycles

- Full employment

![]()

Question 20.

What do you mean by open market operations?

Answer:

It is an instrument of monetary policy which involves buying and selling of govt securities in the open market.

Question 21.

What role of RBI is known as ‘lender of last resort’?

Answer:

The RBI helps the commercial banks in tmes of their financial crisis. When commercial banks are not able to get financial assistance from any source RBI comes to their rescue. The RBI lends money to the commercial banks against the rediscounting of the bills of exchange. This role of the RBI saves the commercial banks from being bankrupt.

Question 22.

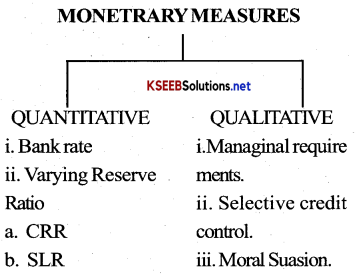

What are the instruments of monetary policy of RBI?

Answer:

There are 2 instruments of monetary policy of rbi

1. Quantitative methods

(a) Bank rate

(b) Open market operation

(c) Cash reserve ratio

(d) Statutory liquidity ratio

2. Qualitative methods

(a) Margin requirements

(b) Credit rationing

(c) Moral suasion

(d) Publicity

![]()

Question 23.

Why is speculative demand for money inversely to the rate of interest?

Answer:

If the interest rate on the bond is low and people expect the interest rate to rise in the future. The negatives relationship between the bond prices and rate of interest. The fall in the bond prices causes capital loss to the bondholders. To counter this situation, the preference for holding bonds falls and desite to hold idle cash balance rises and vice versa. That is Msd = f(ie)

Long Answer Type Questions

Question 1.

Distinguish between Narrow money and Broad money.

Answer:

Narrow Money:

(a) It refers to coins and currency notes with the public, demand deposits with banks and other deposits with RBI

(b) It is represented in M1

(c) It is fully rigid

Broad Money:

(a) The money that is held in the form of savings and net time deposits besides the currency and demand deposits.

(b) It is represented in M3

(c) It includes both full liquid and less liquid money

Question 2.

Distinguish between primary and Derivative deposits

Answer:

Primary deposits:

(a) When a bank accepts cash from the customer and opens a deposit account in his name

(b) It converts currency money into deposit money.

(c) It does not creates credit.

Derivative deposits:

(a) When customers are granted loans and advances by a banks.

(b) It pay loan into customers account directly

(c) It creates credit.

Question 3.

Distinguish between scheduled banks and non-scheduled banks?

Answer:

Scheduled banks

(a) Scheduled banks are those banks which include in the second schedule of RBI Act 1934.

(b) Their paid up capital and reserve fund of Rs.5 lakhs and above

(c) They require required to fulfil certain conditions of RBI

Non Scheduled banks:

(a) Those banks which are not included in second schedule of RBI Act 1934

(b) Their paid up capital and reserve fund is less than Rs.5 lakhs

(c) Less conditions has to be fulfilled of RBI’s wages interest and profit.

![]()

Question 4.

Explain the primary functions of money.

Answer:

Primary functions of money: Money performs two main primary functions.

A medium of Exchange: The most important function ofmoney is that, it serves as a medium of exchange. It facilitates exchange through a common medium i.e. currency. This function of money has eliminated the problem of the lack of double coincidence of wants in barter system. With money purchase and sale can be easily separated.

Measure of value: The values of all goods and services can be expressed interms of money. Money has provided a common yardstick to measure the value of all commodities and services in a common unit known as price this has made different goods and services comparable to each other interms of respective prices.

Question 5.

Write a note on the supply of money.

Answer:

Supply of money refers to aggregate stock of money held by the people in the country at a particular point of time. Currency notes are issued by RBI and coins are issued by Govt of India. Thus, the supply of money at a particular point of time denotes the total amount of money in circulation.

The stock of money has the following 2 major components.

- The currency component.

- The deposit component.

Measures of money supply:

Since, April 1977, RBI has adopted 4 concepts of money supply i.e., M1 M2, M3, and M4

M1: It includes currency with public, demand deposits and other deposits with RBI. It is measured as follows:

M1 = C + DD + OD

Where, C – Currency with public

DD – Demand deposits with commercial bank

OD – Other Deposits with RBI.

M2 = It includes

M = M1 + POSBD

Where, POSBD – Post office savings Deposits.

M3 = It includes

M3 = M1 + TD

Where TD – Time deposits with al banks.

M4 = It includes

M4 = M + TOPD

Where, TOPD – Total Post Office Deposits.

Question 6.

Explain the quantitative methods of credit control.

Answer:

Quantitative methods are non-discriminatory in character as they do expand or contract the flow of money in all the channels.

Bank rate:

The bank rate is the rate of interest charged by the RBI for providing funds or loans to the banking system This is also known as discount rate. It includes commercial and co-operative banks, Industrial Development Bank of India, Industrial Finance corporation, other approved financial institutions. Increase in bank rate, increase the cost of borrowing by commercial banks, Which results in a reduction in the volume of credit. As on 29 October 2013 the bank rate was 8.75 percent.

Open market operations:

It is an instrument of monetary policy which involves buying and selling of govt securities in the open market. The RBI purchases securities to expand the credit and sales to contract it.

Cash Reserve Ratio: (CRR)

It is a certain percentage of bank deposits which commercial banks are required to keep with the RBI in the form of reserves. An increase in CRR with RBI leads to a contraction of credit and vice versa. As of October 2013, the CRR was 4%.

Statutory Liquidity Ratio (SLR):

It is a certain percentage of bank deposits which commercial banks are required to keep with itself in the form of cash reserves The current SLR is 23 %.

Question 7.

Explain the qualitative or selective methods of credit control.

Answer:

Qualitative or selective methods affect money supply indirectly and discriminately. They are:

Margin Requirements:

The difference between the market value of securities and the amount lent against these securities is called margin. A central bank varies the margin requirements from time to time to regulate the volume of the credit.

Regulation of consumer credit Credit given to consumer to buy certain durable goods like cars, TV, washing etc is called consumer credit. This method used to check the consumer credit, by increases margin requirements, reducing repayment period etc.

Control through Directives:

The central bank may enforce the written or oral directives in desired direction to the commercial banks.

Credit Rationing:

The central bank fixes a maximum amount of loans and advances for each commercial bank.

Direct Action:

It refers to the forced measures taken by the central bank against commercial banks. It may refuse to rediscount bills and may charge the panel rate of interest for money borrowed beyond the prescribed limit.

Moral suasion:

This method of control involves the techniques of advice and request made by the central bank to the commercial banks to co-operate with the implementation of its credit policies.

Publicity:

The Central bank by giving regular publicity to money market trends, educates the commercial banks to regulate credit.

Question 8.

Explain the objectives of monetary policy.

Answer:

It is a responsibility of the RBI to frame a suitable monetary policy and ensure that, banks create credit according to the needs of the economy and divert the funds towards desirable sectors.

The important objectives of monetary policy are as follows:

Neutral monetary policy:

It can reduce the fluctuations in the interest rates to the minimum.

Exchange rate stability: – Instability of the exchange rates is harmful for the foreign trade of a country. Thus the central bank can stabilize the rate of foreign exchange by controlling bank credit.

Price stability:

The price fluctuations cause disturbances in the economic system. So RBI, by regulating the supply of credit in accordance with the needs of the people, can bring about price stability in the country.

Control of business cycles:

The objective of economic policy of the RBI should be remove cyclical fluctuations and ensure economic stability in the country.

Full employment:

Economic stability with full employment and high per capita income has been considered as an important objective of monetary policy.

In addition to the above objectives, achieving economic growth and providing social justice are also important objectives of monetary policy.

![]()

Question 9.

Explain the primary functions of the commercial banks.

Answer:

Commercial banks perform primary functions,

(a) Accepting deposits: Accepting deposits is the most important function of commercial banks. They are:

Current account deposits:

Money from these accounts can be withdrawn any number of times as desired by the depositors.

Savings account deposits:

People with low income, salary earners etc, open these accounts. Money is withdrawn only once or twice in a week.

Fixed deposits:

Money in these accounts is deposited for a fixed period of time and cannot be withdrawn before the maturity of the period.

Recurring deposits:

Money in these accounts is deposited in monthly installments for a period of one year or more. After the completion of the last installment, the total amount is paid to the depositor along with the interest.

(b) Advancing loans:

Another important function of commer¬cial banks is to advance loans to the public.

The various types of loans and advances are as follows.

Overdraft:

It is a facility provided by a bank to its current account holders. The banks allows such customers to over draw thier accounts upto certain limit. It available to business firms and companies.

Cash credit:

It is a type of loan which is given to the borrower against the current assets such as shares, stocks, bonds etc.

Loans:

The loan is a financial arrangement in which credit is provided by a commercial bank through opening a separate account loan account. Interest is charged on the entire amount sanctioned by the bank.

Discounting of bills of exchange:

It means encashing the bills of exchange from the banks before the date of maturity. The bank deducts a certain amount of discount from the face value of the bill and pays the balance to the person discounting the Biji.

Question 10.

What is money? Explain the functions of money?

Answer:

According to F. A. walker “ Money is what money does”.

The Functions of money are classified under four categories Namely

- Primary Functions

- Secondary Functions

- Contingent Functions

- Other Functions

1. Primary Functions:

Money performs are two main primary Functions:

A medium of Exchange:

The most important function of money is that, it serves as a medium of exchange. It facilitates exchange through a common medium i.e, currency. This function of money has eliminated the problem of the lack of co-incidence of wants which was the main difficulty under barter system. Money has widened the scope of market.

Measure of value:

Money serves as a common unit of value. The values of all goods and services can be expressed in terms of money. Money has provided a common yard stick to measure the value of all commodities and services in a comon unit known as price. This has made different goods and services comparable to each other in terms of respective prices.

2. Secondary Functions of Money:

The secondary functions of money can be divided into following three parts.

Standard of deferred Payments:

Money can be used for fixture payments. deffered payments refer to the future payments and contractual payments such as loans and interest payments, salaries etc. This function has attained more significance in modem times with the expansion of trade based on credit.

Store of value:

Money is used as a store of value. As money is not perishable and as the value is comparatively stable, it can be stored for any number of days. People can store a part of their present earnings for fixture use. Thus money is a bridge from present to future. This function ofmoneypromoted savings, investment and capital formation.

Transfer value:

Money has been a measure of transferring wealth from one place to another. As money has general acceptability, purchasing power can be transferred from one person to another or from one time to another. Thus money serves both for the time transfer and place transfer of purchasing power.

3. Contingent Functions of Money:

The following are the various contingent functions ofmoney.

Distribution of National Income:

Money facilitates the distribution of national income among the four factors of production as a reward in the form of rent, wages, interest and profit.

Basis of credit:

The modem economy is based on credit. Money serves as a basis of the vast structure of modem credit system.

Maximizes consumers and producers satisfaction:

The money plays an important role in equalizing the marginal utilities of the consumer because the prices of all commodities are expressed in money. Like wise, money also helps the producer in equalizing marginal productivities because ultimately these productivities are measured in terms of money.

Liquidity and uniformity

Money gives liquidity to various forms of wealth. That is money is most liquid form of all the assets and wealth. Money can be connected into any type of asset and type of asset can be converted into money. ‘ ’

4. Other Functions of money are:

- Helpful in making or taking decisions for daily requirements

- Represents generalized purchasing power

- Safeguards repayment capacity.

Question 11.

Explain the three motives of Demand for money?

Answer:

Money is the most liquid form of asset. The demand for money refers to the total money demanded by the people in the form of cash for various purposes.

According to Keynes, the demand for money arises because of the following three motives:

- Transaction motive

- Precautionary motive

- Speculative motive

Transaction motive:

We incur some or the other expenditure to fulfill our day-to-day needs such as food, shelter, clothing, etc. In other words, we require to hold some portion of money in the form of cash to meet our daily expenses. Thus, transaction motive relates to the demand for money for the day-to-day expenditure of individuals and business firms. Holding cash to meet daily transactions is called transaction demand for money. The need for holding cash arises because there is a time gap between receipt and income and the consumption expenditure.

Usually, people receive income at certain intervals of time such as a week, a month, etc., which is to be consumed throughout the period till the next receipt. Thus people have a tendency to hold money in cash for various transaction purposes. This demand for money is a positive function of income. As income rises, people tend to spend more, consequently, they demand more money to carry out the increased transaction needs. Algebraically.

Mpd = f(y)

Where, Mpd = Represents the transaction demand for money.

Y = Represents the income of an individual

f = Represents functional relationship between transaction demand for money and individual income.

As y tends to rise Mpd will also rise.

Precautionary Motive:

The future is full of uncertainties. Sometimes people hold some amount of money for unforeseen expenses such as medical expenses, accidents, emergencies, etc. The demand for money to meet these unforeseen and unexpected expenses is known as precautionary demand for money. Like the transaction demand for money, precautionary demand for money is also a positive function of income. As income rises precautionary demand for money also rises and vice versa. Algebraically,

MMpd = f(y)

Where, Mtd = Represents the Precautionary demand for money.

Y = Represents the income of an individual

f = Represents functional relationship between Precautionary demand for money and individual income.

As y tends to rise Mp will also rise.

Speculative Motive:

Besides cash, people also tend to hold wealth in the form of property, gold, bonds, shares, etc. The speculative demand for money refers to the demand for money that people hold as idle cash balance to speculative with the aim of earning capital gains and profits. Keynes assumed that people store wealth in the form of money or bonds. Bonds refer to the financial papers that bear the promise of a future stream of monetary income over a period of time.

The bonds are issued by the firms to borrow from the general public. Keynes demonstrated that there exists an inverse relationship between the rate of interest and speculative demand for money.

If the interest rate on the bond is low, and people expect the interest rate to rise in the future. This implies that people expect the bond price to fall because of the negative relationship between the bond prices and the rate of interest. This fall in the bond prices causes capital loss to the bondholders. To counter this situation, the preference for holding bonds falls and desire to hold idle cash balance rises. Thus speculative demand for money rises.

On the other hand, if the current interest rate on securities and bonds is high, then people expect the interest rate to fall in the future. This implies that people expect bond prices to rise in the future this is because the negative relationship between bond prices and the rate of interest. This rise in the bond prices implies a capital gain’ to the bond holders. Consequently, the preference to hold bonds increase and the people desire to hold lesser idle cash balances. There by the speculative demand for money falls.

Hence, the speculative demand for money is inversly related to the expected rate of interest.

That is Mbd – f(y)

Where, Mbd = Represents the speculative demand for money.

Y = Represents the expected rate of interest

f = functional relationship between speculative demand for money and expected rate of interest.

![]()

Question 12.

Explain the functions of commercial banks?

Answer:

Commercial banks play an important role in the economic life of a country. These banks perform a variety of functions and help the businessmen and the traders. Modern commercial banks perform mainly two types of functions.

- Primary functions:

- Secondary functions.

1. Primary functions:

Accepting deposits is the most important function of commercial banks. They accept several types of deposits form the public. They are discussed below

Current account deposits:

These deposits are payable on demand. Money from these accounts can be withdrawn any number of times as desired by the depositors. Normally, no interest is paid on these deposits. These accounts are generally maintained by the traders and businessmen. Current deposits are also called demand deposits.

Saving account deposits:

People with low income, salary earners, etc., generally open these accounts, certain restrictions are imposed on these accounts regarding the number of withdrawals. Money deposited in the account can be withdrawn either once or twice a week. Rate of interest paid on these deposits is low as compared to that on fixed deposits. This type of account encourages and mobilizes small savings in the country.

Fixed deposits:

Money in these accounts is deposited for a fixed period of time and cannot be withdrawn before the maturity of that period. The rate of interest paid on these deposits is higher than that on other deposits. The rates of interest depend upon the period for which money is deposited. The longer the period, the higher is the rate of interest. Fixed deposits are also called time deposits.

Recurring deposits:

Money in these accounts is deposited in monthly installments for a period of one year or more. After the completion of the last installment, the total amount accumulated is paid to the depositer along with the interest. The rate of interest on these deposits is nearly the same as on fixed deposits.

Advancing of loans:

Another important function of commercial banks is to advance loans to the public. After keeping certain portions of cash reserves the banks lent remaining portion of deposits to the needy borrowers.

The various types of loans and advances are as follows:

1. Overdraft:

It is a facility provided by a bank to its current accounts holders. The bank allows such customers to over draw their accounts upto certain limit, interest is charged on the amount actually overdrawn by the customer. This facility is generally available to business firms and companies.

2. Cash credit:

It is a type of loan which is given to the borrower against the current assets, such as shares, stocks, bonds etc. The bank opens the account in the name of the borrowers and allows him to withdraw the money from time to.time up to a certain limit as determined by the value of his current assets. Interest is charged only on the amount actually withdrawn from the amount.

3. Loans:

Loan is financial arrangement in which credit is provided by a commercial bank through opening a separate account is called loan account. In this method the bank gives a specified sum of money to a person or a firm against some collateral security. The loan amount is credited to the account of the borrower and the borrower can withdrawn money from the account according to his requirements. But the interest is charged on the entire amount sanctioned by the bank.

4. Discounting of bills of exchange:

This is another type of lending by the modem banks. Discounting the bill of exchange means encashing the bills of exchange from the banks before the date of maturity. The bank deducts a cartain amount of discount from the face value of the bill and pays the balance to the person discounting the bill. The discount deducted by the bank is actually the amount of interest (discount charge) charged by the bank for lending the money.

2. Secondary functions:

Commercial banks also perform certain other functions. These are called secondary functions. They are mainly of two types.

- Agency services

- General Utility services.

Besides, the commercial banks have started performing a number of other functions- in recent years, such are banking, merchant banking, mutual funds, advances to priority sector like agriculture, small scale industries, retail trade, small business, self employment, consumption loans, educational loans, housing loans etc.

Question 13.

What is Credit creation? How do the banks create credit?

Answer:

Creation of credit is one of the most important functions of commericial banks. According to R.S.Sayers “Banks are not merely purveyors of money, but also manufactures of money”. Bank credit means bank loans and advances. A bank keeps a certain proportion of its deposits as minimum reserve for meeting the demand of the depositors and lends out the remaining reserve to earn income. The bank loan is not paid directly to the borrower but is only creadited to his account and allows him to withdraw the required amount. Every bank loan creates an equivalent deposit in the bank. In this way the bank creates credit. Thus credit creation means expansion of deposits.

Bank deposits arise in two ways.

- Primary deposits

- Secondary m derivative deposits

Primary deposits:

When a bank accepts cash from the customer and opens a deposit account in his name, it is called primary deposit. The creation of primary deposit does not mean credit creation. These deposit simply convert currency money into deposit money.

Derivative deposits:

Deposits also arise when customers are granted loans and advances by a bank, such deposits are called derivative deposits. When a bank grants a loan to its customer it does not actually pay cash to him but simply credit to the customer’s account. Thus, whenever a loan is granted, derivative deposit is created by the bank.

Therefore, credit creation is nothing but expansion of bank deposits through the process of loans and advances as well as investments.

Central bank is the first source of money supply in the form of currency in circulation. The RBI is the note-issuing authority of the country. The RBI ensures availability of currency to meet the transaction needs of the economy.

The commercial banks are the second sources of money supply. The money that commercial banks supply is called credit money.

![]()

Question 14.

Explain the functions of the RBI.

Answer:

RBI is the apex banking institution in the country. It was established on April 1,1935 as per the RBI Act, 1934 as a private shareholders bank.

After the independence RBI was nationalised by the government on 1st January 1949 and converted it as the central Bank of country. It has the pivotal place in the banking sector and directly controls all the banks and financial Institutions in the country.

Resources: RBI as paid up capital of Rs. 5 crore. The capital is composed of 5 lakh shares of Rs. 100 each. All the shares are held by the central Government.

Management: The management and supervisior of RBI is entrusted to a central Board of Director with 20 members of these 20 directors one is a governor, 4 pity governors, one director of finance department, 10 directors selected from fields and nominated by the Government and 4 representation of the regional boards in kolkta, chennai, Mumbai and Delhi.

Functions are explained in brief as given below.

1. Traditional functions

The traditional functions of the RBI are as follows:

Issuing currency notes:

RBI has authority of pringing and issuing currency notes in the country. Expect the Due rupee note the RBI issues denomination of Rs. 2, 5, 10, 20; 50, 100, 500 and Rs. 1000 currency notes in the country. The one rupee is issued by finance ministry of central government. From 1956 onwards the RBI is following minimum reserve system of Note Issue. Where it has kept Rs. 200 crore worth of reserve (Rs. 85 crore worth of Gold and Rs. 115 crore worth of foreign exchange) against the currency issued.

Banker to Government:

RBI act as banker, agent and adviser to the Government. As a government banker and agent it opens accounts of the government, exeires money and makes payments on behalf the government, transfer government funds, given credit to the government, manages public debt, and maintains amounts of expenditure. As an adviser, it advises the government on all financial matters.

Bankers Bank:

RBI acts as bankers bank. All the banks in the country are within the control of RBI. According to Banking Regulations Act. 1949 all commercial banks in country have to keep certain portion of their deposits as cash reserve with the RBI. RBI also gives the credit to banks by discounting the bills and advancing money on various securities. RBI also provides cleainig house facilities to banks for the settlement of inter bank claims.

Credit control:

RBI has the important function of control of credit generated by commercial banks in the country. It is an important function of the RBI. RBI exercises both quantitative techniques to control credit.

The quantitative methods of credit control includes.

(a) Bank rate policy

(b) Open market operations

(c) Cash reserve ratio.

(d) statutory liquidity ratio etc.,

The quantitative techniques are:

(a) Giving directions to banks

(b) Margin requirements.

(c) Moral seasion

(d) Direct action etc.,

Leader of money market:

RBI is the leader of money market in the country. It controls the activities of different components of the money market such as commercial banks, financial institutions, etc.

Custodian of foreign exchange reserves:

RBI preserves and protects the precious foreign exchange of the country. It has continuous contacts with international monetary institutions.

Lender of Last resort:

BBI is the lender of last resort to all the commercial banks in the country. The RBI lends money to banks by en-discounting bills and advancing money on other securities.

Clearing house:

RBI acts as clearinghouse. The mutual claims of banks are settled through books adjustments by way of accounts of various banks maintained by the RBI.

2. Development functions

In addition to the traditional functions, RBI performs the following developmental functions.

Agricultural finance:

RBI has the sperate agricultural is apex institution. Which was extablished in year 1935. Which consist of paid up capital of Rs. 5 crores and its consists of management which includes 20 members under that one is governor. 4 deputy governor one director fo finance and 10 director selected from other fields.

So the main instruments of monetary policy of RBI includes:

1. Quantitative or General controls:

This are the main controls under RBI where it includes control like

(a) Bank rate

(b) Cash Reserve Ratio

(c) Open market operation

(d) statutory liquidity ratio

(a) Bank Rate policy (BRP)

The bank rate has been defined in the Reserve Bank of India Act as the standard rate at which it (the RBI) is prepared to buy or rediscount bills of exchange or other commercial papers eligible for purchase under this Act.

(b) Open Market Operations (OMO):

It this defined by RBI refers to “Broadly to the purchase and sale by central bank of a variety of Assets such as foreign exchange, gold, government securities and even company shares”.

(c) Variable Reserve Ratio (VRR):

RBI also uses the method of VRR to control in credit in INdia. Under this every bank is enquired by law to keep a certain percentage of its total deposits in the form of a reserve fund and also a certain percentage with the RBI.

This ratio includes two types of requirements

- Cash Reserve Ratio (CRR)

- Statutory Liquidity Ratio (SLR)

1. Cash Reserve Ratio (CRR):

CRR refers to that portion of total deposits of a commercial bank which it as to keep with the RBI in the form of cash reserve under the RBI (Amendment Act of 1962) RBI is empowered to determine CRR for the commercial banks in the range of 3%-15% for the agreement demand and time availabilities.

2. Staturtory liquidity Ratio (SLR):

SLR refers to that portion of total deposits of a commercial banks which it as to keep with itself in the form of cash reserves.

According to banking regulation (Amendment Act of 1962) maintains a minimum statutory liquidity ratio of 25% by the banks against their net demand and time liabilities. But RBI to raises SLR up to 40%.

Selective credit controls or Qualitative:

Selective credit controls are considered as useful supplement to general credit regulation. This control were introduced by the RBI for the first time in 1956.

This controls are meant to regulate credit for specific purposes. This control consist of three techiniques viz, the determination of margin requirements for loans, determination of maximum amount of advances and charging of discriminatoiy interest rates.

Exercises

Question 1.

What is a barter system? What are its drawbacks?

Answer:

Barter system is a system that was used in ancient times to exchange goods. In other words, this system was used to exchange one commodity for another before the monetary system came into existence. For example, if a person having rice wants tea, then he can exchange rice with a person who has tea and needs rice. The economy having the barter system was called ‘C-C economy’, i.e. commodity is exchanged for commodity.

The various drawbacks of the barter system are as follows:

1. Lack of double coincidence: the lack of double coincidence ofwants is the maj or drawback, it is very rare when the owner of same good or service could find some who wanted his good or service and possessed that good or service that the first person wanted, no exchange is possible if the double coincidence is not there.

2. Lack of common unit of value: Under barter system, there was no common unit for measuring the value of one good in terms of the other good for the purpose of exchange. For example, a horse cannot be measured in terms office in the case of exchange between rice and horse.

3. Difficulty in wealth storage: It was very difficult to store commodities for future exchange purposes. Perishable goods like grains, milk, and meat could not be stored to exchange goods in the future. Therefore, wealth storage was a major difficulty of batter system,

4. Lack of standard of deferred payments: The future payments could not be met in a C-C economy (barter system) as wealth could not be stored. It was very difficult to pay back loans.

![]()

Question 2.

What are the main functions of money? How does money overcome the shortcomings of a barter system?

Answer:

The main functions of money are as follows:

1. Medium of exchange: Money acts as a medium of exchange as it facilitates exchange through a common medium, i.e. currency. In other words, money helps in the buying and selling of goods. For example, a person can self his goods to another for money and that person can use money to purchase goods of his choice. Money solves the problem of double coincidence of wants.

2. Unit of value: The values of goods can be measured in terms of money. It is a common medium through which we can calculate the value of each and every good. The value of a good in tenns of money is called the price. In barter system the lack of a common denominator for measuring values of goods was a major drawback.

3. Store of value: This function explains the importance of money as value storage. This implies that wealth in the form of money can be stored easily as a medium of exchange for future use. For example, money can be stored in banks for meeting emergency and future needs.

4. Standard of deferred payments: Payments can easily be made through the medium of money. In other words, it is very difficult to pay back a loan in terms of goods and services. However, with the advent of money the payments of loans or interests can easily be made.

Money overcomes the shortcomings of barter system in the following manner:

- Money solves the problem of double coincidence of wants. For example, if a person needs wheat in exchange of tea, then he/she must search for a person who is ready to trade wheat for tea.

- In barter system, it was very difficult to measure the value of one good in terms of another. For example, it is difficult to calculate the value of a cow in terms of wheat.

- It was very difficult to store goods, especially perishable goods (Suits, meat, etc.) for the purpose of value storage. Money serves this purpose.

- The contractual or future payments are much difficult to be made in barter system. For example, a worker working on contract basis could not be paid in terms of rice or chairs.

Question 3.

What is transaction demand for money? How is it related to the value of transactions over a specified period of time?

Answer:

Transaction demand for money refers to the demand for money for meeting day-to-day transactional needs. As money is a liquid asset (easily acceptable or exchangeable), everyone has the tendency to hold money. People earn incomes at distinct points of time but consume throughout the entire period. So, people tend to hold money for transaction purposes.

The relationship between the value of transactions and transaction demand for money can be explained as:

The transaction demand for money in an economy MTD can be written as MTD = KT

Or, \(\frac{1}{k}\)M° = T = T

Or, MTD = T Where,

v\(\frac{1}{k}\), represents velocity of circulation of money

T = Total value of transactions in the economy over a period of time K is a positive fraction M” = Stock of money people are willing to hold at a particular point of time.

The transaction demand for money is positively related to the total value of transactions and negatively related to the velocity with which money is circulated.

Question 4.

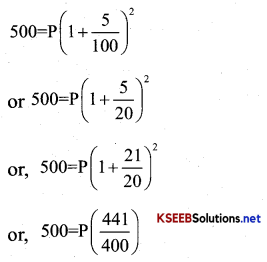

Suppose a bond promises Rs.500 at the end of two years with no intermediate return. If the rate of interest is 5 percent per annum what is the price of the bond?

Answer:

Let the price of the bond be Rs. P We know that,

A = P\(\left(1+\frac{r}{100}\right)^{n}\)

It is given that

A = Rs.500

r = 5%

n = 2 years

Substituting the values in.the formula

Or, P = \(\frac{200000}{4}\) = 453.51

So, P = Rs. 453.51

Therefore, Price of the bond is Rs. 453.51.

Question 5.

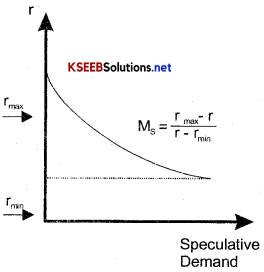

Why is speculative demand for money inversely related to the rate of interest?

Answer:

Speculative demand for money is made for return in the form of interest, hence rate of interest determiners the speculative demand for money of the rate of interest higher the speculative demand for money will be low and vice versa, the reason is that people willconvert their money into bonds when the interest on bond is higher, in that case demand for speculative purpose will be low. On the other hands of the rate of interest is lower than the expected interest, people will not convert their money in bonds and keep money in hand for speculative purpose. In this way a specular demand money in inversely related to the rate of interest.

![]()

Question 6.

What is ‘liquidity trap?

Answer:

Liquidity trap is a situation in which speculative demand function is infinitely elastic; it is explained as follows:

The price of a bond has an inverse relationship with the market interest rate. If the interest rate is very high and people expect it to fall in the future, then the bond prices will rise being inversely related to the interest rate. In order to earn capital gains in future, people will purchase bonds (as bonds are cheaper) and hence the speculative demand for money will become low. On the contrary, if the interest rate is low and people expect it to rise in future, then the bond prices will fall and in order to avoid capital loss, people will sell their bonds and convert their bonds into idle cash balances.

Liquidity trap is an extreme case of the latter situation. When the interest rates are very low, then everyone expect interest rates to go up in future. Thus, to avoid capital loss, everybody prefers to maintain cash balance and not bond. Consequently, the speculative demand for money is infinitely elastic. In this situation, if the additional money is pumped into the economy, then, this will only satisfy the thirst for money, without increasing the demand for bonds. Pumping additional money in this situation will further exaggerate the condition as this will further reduce the interest rate below γmin.

The relationship between speculative demand for money and the rate of interest is given as:

Mds = \(\frac{r_{\min }-r}{r-r_{\min }}\)

In the above diagram, interest rate is represented on the vertical axis and speculative demand on the horizontal axis. When r= r min, the economy is in liquidity trap, where the speculative demand for money is infinite elastic.

Question 7.

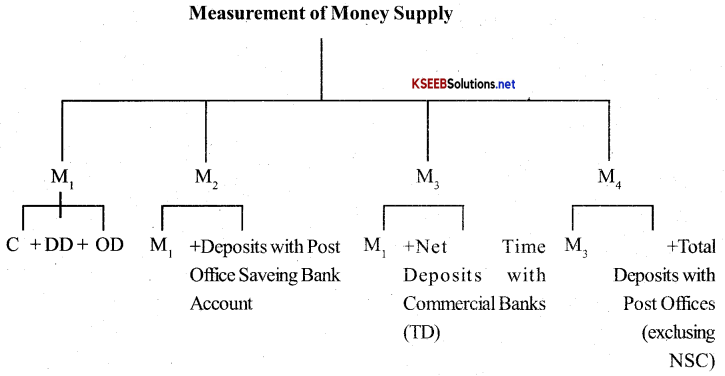

What are the alternative definitions of money supply in India?

Answer:

The various definitions of money supply in Inida as prescribed by RBI are M1 M2 M3 and M4.

M1, M2, M3, and M4 have arranged the descending order of liquidity. In other words, M1, has the highest liquidity and M4 has the least liquidity.

So M1 =C+DD+OD Where,

C – Currency held by public

DD = Net demand deposits of the bank

OD = other deposits held by RBI

M2 = M1 + Savings of the people with Post offices (M1 includes the components of M as well as the savings of people with Post office.)

M3 = M1 + Net time deposits with commercial banks (M1 is the most commonly used measure of the money supply. It indues the components of M1 and net time deposits of commercial banks.)

M4 = M3 + Total deposits with post offices (excluding National Saving certificate)

All these definitions of money supply in India are represented in the flow chart given below.

Question 8.

What is a ‘legal tender? What is ‘fiat money’?

Answer:

Legal tender: Legal tender means the acceptance of the money the citizens of a country for settlement of any kind of transaction.

Fiat money: Fiat money is that money which does not have intrinsic value like gold, silver coins.

Question 9.

What is High Powered Money?

Answer:

High powered money is the total liability ofthe monetary authority of the country. This is also called the monetary base and is created by the RBI. High powered money includes currency (notes and coins), deposits with the government and reserves of commercial banks with RBI.

So, to sum up, high powered money is

H = C + R Where

H – High powered money

C – Currency

R – Cash Reserves of commercial banks

![]()

Question 10.

Explain the functions of a commercial bank.

Answer:

Commercial banks perform various functions that are as follows:

(a) Accepting deposits: The basic function of commercial banks is to accept deposits of the customers. These deposits are of the following types:

1. SavingAccounts: Saving accounts cater to the needs of those individuals who wish to save a part of their income and earn interest on the amount saved. Account holders of saving accounts can deposit

cheques, drafts, etc. However, there is a limit on withdrawal.

2. Fixed deposit accounts: As the name suggests, fixed deposit accounts imply deposits are kept for fixed periods oftime; for example, Rs.500 per month for 5 years. The period has to be decided in advance, while opening the account. Holders of these accounts do not enjoy the cheque facility. Higher the time period, higher will be the interest rate, which is decided by RBI.

3. Current deposits accounts: Current deposit accounts are also called ‘demand deposits’ as the depositor can withdraw money at any time through cheques. Businessmen use this accouht to make many transactions in a single day; however, they do not earn interest on the deposits. Banks provide account statements to the current account holders at regular intervals.

(b) Granting loans and advances: The second most important function of the commercial banks is to give loans and advances. The rate of interest charged by the banks on loans is higher than the rate of interest paid by the banks on demand deposits and saving deposits. Loans granted by commercial banks are generally for long term and are given against securities. Advances are given by abank only for a short span oftime

(c) Agency functions : The commercial banks perform various agency functions with the prime purpose of acceptance of deposits and granting of loans.

Their functions include:

- Transfer of funds-The banks provide easy flow of funds from place to place via mail transfers, demand drafts, etc.

- Collection of funds- The banks also collect funds on behalf of its customers through bills, cheques, etc.

- Banks collect insurance premiums, dividends, interest on debentures, etc.

- Banks assist in the process oftax payment by the accountholders.

- Banks also play the role of trustees or executors.

(c) Discounting bills of exchange:

Commercial Banks provide financial assistance to the business community by discounting bills of exchange. The banks purchase these bills, produced by customers, by deducting interest from the face value of the bill, thus providing easy finances to the business community when required.

(d) Credit creation: Commercial banks create credit in the economy through demand deposits. Credit creation paves the path for the growth of the economy.

(e) Other functions:

- Providing locker facility

- Purchase and sale of foreign exchange

- Issue of gift cheques

- Underwriting of shares and debentures

- Providing information and statistical data useful to customers

Question 11.

What is money multiplier? How will you determine its value? What ratios play an important role in the determination of the value of the money multiplier?

Answer:

Money multiplier is the ratio of the stock of money to the stock of high powered money in an economy

i.e. MM = \(\frac{\mathrm{M}}{\mathrm{H}}\)

Where, is the money multiplier M represents stock of money H represents high powered money The value of money multiplier is always greater than 1.

The value of money multiplier can be derived as follows:

We know that M = C + DD = (1 + cdr) DD

Where M=Money supply

C = Currency held by people

cdr=Currency deposit ratio

DD=Demand deposits

Let treasury deposits of government be D

We know, High powered money = Currency + Reserve money

Or, H = C + R

= cdrD + rdrD

= D (cdr+rdr) (Taking D common)

Money multiplier = \(\frac{\mathrm{M}}{\mathrm{H}}\)

So, the ratio ofmoney supply to high powered money \(\frac{\mathrm{M}}{\mathrm{H}}\) becomes

But rdr < 1

So, \(\frac{\mathrm{M}}{\mathrm{H}}=\frac{1+\mathrm{cdr}}{\mathrm{cdr}+\mathrm{rdr}}\) >1

The currency deposit ratio (cdr) and the reserve deposit ratio (rdr) play an important role in determining the money multiplier.

The currency deposit ratio (cdr) is the ratio of the money (currency) held by public to that they hold in bank deposits.

That is, cdr = \(\frac{\mathrm{C}}{\mathrm{DD}}\)

The reserve deposit ratio (rdr) is the proportion of the total deposits kept by the commercial banks as reserve.

Question 12.

What are the instruments of monetary policy of RBI? How does RBI stabilize money supply against exogenous

shocks?

Answer:

The monetary policy(credit policy) of RBI involves the two instruments given in the below

Quantitative Measures: Quantitative measures refer to those measures that affect the variables, which in turn affect the overall money supply in the economy.

Instruments of quantitative measures:

(a) Bank rate: The rate at which central bank provides loan to commercial banks is called bank rate. This instrument is a key at the hands of RBI to control the money supply. Increase in the bank rate will make the loans more expensive for the commercial banks; thereby, pressurizing the banks to increase the rate of lending. The public capacity to take credit wall gradually fall leading to die fall in the volume of credit demanded. The reverse happens in case of a decrease in the bank rate. The increased lending capacity of banks, as well as increased public demand for credit, will automatically lead to a rise in the volume of credit.

(b) Varying reserve ratios: The reserve ratio determines the reserve requirements, wherein banks are liable to maintain reserves with the central bank.

The three main ratios are:

1. Cash Reserve Ratio (CRR): It refers to the minimum amount of funds that a commercial bank has to maintain with the Reserve Bank of India, in the form of deposits. For example, suppose the total assets of a bank are worth Rs.200 crores and the minimum cash reserve ratio i s 10%. Then the amount that the commercial bank has to maintain with RBI is Rs.20 crores. If this ratio rises to 20%, then the reserve with RBI increases to Rs.40 crores. Thus, less money will be left with the commerci al bank for lending. This will eventually lead to considerable decrease inthe money supply. On die contrary, a fall in CRR will lead to an increase in the money supply.

2. Statuary Liquidity Ratio (SLR): SLR is concerned with maintaining the minimum reserve of assets with RBI, whereas the cash reserve ratio is concerned with maintainingcash balance (reserve) with RBI. So, SLR is defined as the minimum percentage of assets to be maintained in the form of either fixed or liquid assets with RBI. The flow of credit isreduced by increasing tliis liquidity ratio and vice-versa In the previous example, this can be understood as rise in SLR will restrict the banks to pump money in-the economy, thereby contributing towards decrease in money supply. The reverse case happens if there is a fall in SLR, as it increases the money supply in the economy.

(c) Open Market Operations (OMO):

Open Market operations refer to the buying and sell ing of securities in an open market , in order to affect the money supply in the economy. The selling of securities by RBI will wipe out the extra cash balance from the economy, thereby limiting the money supply, whereas in the case ofbuying securities by RBI, additional money is pumped into the economy stimulating the money supply.

Qualitative Measures:

The measures that affect the credit qualitatively are:

1. Marginal Requirements: The commercial banks’ function to grant loan rests upon the value of security being mortgaged. So, the banks keep a margin, which is the difference between the market value of security and the loan value. For example, a commercial bank grants loan ofRs. 80,000against security of Rs. 1,00,000. So, the margin is calculated as 1,00,000 – 80,000 = 20,000. When the central bank decides to restrict the flow of money, then the margin requirement of loan is raised and vice-versa in the case of expansionary credit policy.

2. Selective Credit Control (SCC’s): An instrument of the monetary policy that affects the flow of credit to particular sectors positively and negatively is known as selective credit control. The positive aspect is concerned with the increased flow of credit to the priority sectors. However, the negative aspect is concerned with the measures to restrict credit to a particular sector.

3. Moral suasion: this method of credit control involves the techniques of advance and requests made by the central bank to the commercial banks to co-operate with the implementation of its credit policies, central bank may request commercial banks not to give loans for un-productive purposes, which does not add to economic growth but increases inflation.

![]()

Question 13.

Do you consider a commercial bank ‘creator of money’ in the economy’?

Answer:

Commercial banks play the important role of money creator in the economy. They have the capacity to generate credit through demand deposits. These demand deposits make credit more than the initial deposits.

The process of money creation can be explained by taking an example of a bank XYZ. A depositor deposits Rs. 10,000 in his savings account, which will become the demand deposit of the bank. Based on the assumption that not all customers will turn up at the same day to withdraw their deposits, bank maintains a minimum cash reserve of 10 % of the demand deposits, i.e. Rs. 1000. It lends the remaining amount ofRs.9000 in the form of credit to other customers. This further creates deposits for the bank XYZ. With the cash reserve ofRs. 1000, the credit creation is worth Rs. 10,000.

So, the credit multiplier is given by:

Credit multiplier = 1/CRR = 1/10%= 10

The money supply in the economy will increase by the amount (times) of credit multiplier.

Question 14.

What role of RBI is known as ‘lender of last resort’?

Answer:

When a commercial bank faces financial crisis and fails to obtain funds from ether sources, then the central bank plays the vital role of ‘ lender of last resort ’ and provides them with the financial assistance in the form of credit: This role of the central bank saves the commercial bank from bankruptcy. Thus, the central bank plays the role of guarantor for the commercial banks and maintains a sound and healthy banking system in the economy.