Students can Download Maths Chapter 9 Commercial Arithmetic Ex 9.6 Questions and Answers, Notes Pdf, KSEEB Solutions for Class 8 Maths helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka Board Class 8 Maths Chapter 9 Commercial Arithmetic Ex 9.6

Question 1.

A person purchases the following items from a mall for which the sales tax is mentioned against.

(a) Stationary materials for Rs. 250 and sales tax of 4% there on.

(b) Electronic goods worth Rs. 2580 and sales tax of 10% there on.

(c) Groceries worth Rs. 1200 on which sales tax of 3% is levied.

(d) Medicines worth Rs. 200 with sales tax of 6%. Find the bill amount for each item.

Answer:

(a) Marked price Rs. 250, and sales tax 4%

Amount to be paid = marked price + tax

Tax

![]()

Bill amount = 250+10 = Rs. 260.

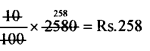

(b) Marked price is Rs. 2580 and sale tax 10%

Tax =

Bill amount = 2580 + 258 = Rs. 2838.

(c) Marked price Rs. 1200 and tax 3%

Tax =

![]()

Bill amount = 1200 + 36 = Rs. 1236.

(d) Marked price Rs. 200 and sales tax 6%

Tax =

![]()

Bill amount = 200 + 12 = Rs. 212.

Question 2.

A person buys electronic goods worth Rs. 10,000 for which the sales tax is 4% and other material worth Rs. 15,000 for which the sales tax is 6%. He manufactures a gadget using all these and sells it at 15% profit, what is his selling price?

Answer:

Price of the electronic goods is Rs. 10,000 and tax is 4%

∴ Tax =\(\frac { 4 }{ 100 }\) × 10,000 = Rs.400

Total cost = 10,000 + 400 = Rs. 10,400

Price of the other material is 15,000 and tax is 6%.

∴ Tax = \(\frac { 6 }{ 100 }\) × 15,000 = Rs.900

Total cost = 15,000 + 900 = Rs. 15,900

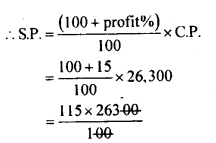

Total cost price of the electronic gadget prepared by him is (10400 + 15900) = 26300

Profit percent = 15%

selling price = Rs. 30,245

Question 3.

A trader purchases 70 kg of tea at the rate of Rs. 200 kg and another 30kg at the rate of Rs. 250/kg. He pays a sales tax of 4% on the transaction. He mixes both of them and sells the product at the rate of Rs. 240/kg. What is the percentage gain or loss (find approximate value)?

Answer:

The cost of 70 kg of tea at the rate Rs. 200/ kg is 200 x 70 = Rs. 14000

The cost of 30kg of tea at the rate Rs 250/ kg is 250 x 30 = Rs 75000.

Total cost of 100kg = 14000+7500 = Rs. 21,500

Rate of tax 4%

∴ Tax = \(\frac { 4 }{ 100 }\) × 21,5000 = Rs.860

Total cost price = 21,500 + 860 = Rs. 22,360

S.P of 100kg tea at Rs. 240/Kg

= 100 x 240 = Rs. 24,000

S.P > C.P

Profit = S.P – C.P

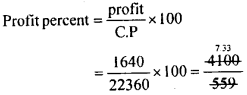

= 24,000 – 22360 = Rs. 1640

Profit percent = 7.33%