Students can Download 2nd PUC Accountancy Model Question Paper 1 with Answers, Karnataka 2nd PUC Accountancy Model Question Papers with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 2nd PUC Accountancy Model Question Paper 1 with Answers

Time: 3 Hrs 15 Min

Max. Marks: 100

Instructions: –

- All sub questions of Section – A should be answered continuously at one place.

- Provide working notes wherever necessary.

- 15 minutes extra time has been allotted for the candidates to read the questions.

- Figures in the right hand margin indicates full marks.

Section – A

I. Answer any Eight questions, each question carries One mark : ( 8 × 1 = 08 )

Question 1.

Government grant is treated as …………….. receipt.

Answer:

Revenue Receipt

Question 2.

State the minimum number of persons required to form a partnership.

Answer:

2 persons

Question 3.

Accumulated profits are transferred to all partners’ capital account including new partner [True / False].

Answer:

False

Question 4.

Amount due to deceased partner is settled in the following manner ………….

[a] Immediate full payment

[b] Transferred to loan account

[c] Partly Paid in cash and balance transferred to loan account

[d] All of the above

Answer:

All of the above

![]()

Question 5.

Profit on forfeited shares is transferred to account

Answer:

Capital reserve

Question 6.

Name any one method of redemption of debentures.

Answer:

Payment is lump sum or any ether one

Question 7.

Write one objectives of financial statements.

Answer:

To provide information about economic resources and obligations of a business or any other one.

Question 8.

Comparative statement analysis is also known as …………

[a] Dynamic analysis

[b] Horizontal analysis

[c] Vertical analysis

[d] External anlysis.

Answer:

[b] Horizontal analysis

Question 9.

Expand E.P.S

Answer:

E.P.S = Earnings per share

Question 10.

Give an example for cash inflows from financing activities.

Answer:

Cash proceeds from issuing shares (equity or / and preference) or any other.

Section – B

II. Answer any Five questions, each question carries Two marks : ( 5 × 2 = 10 )

Question 11.

What is Capital Fund? 2 marks

Answer:

Capital fund is the difference between the assets and liabilities of the not for profit organization. It is aggregate capital items like legacies, entrance fees and lite membership fees.

Question 12.

Write any two contents of partnership deed.

Answer:

Contents of partnership deed.

- Name and addresses of the firm.

- Name and address of all the partners or any other

![]()

Question 13.

State any two methods of valuation of goodwill.

Answer:

The important methods of valuation of goodwill are as follows

- Average profits method

- Super profits method or any other

Question 14.

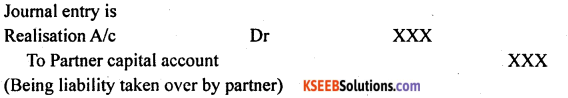

Give the journal entry for a liability taken over by a partner on dissolution of firm.

Answer:

Question 15.

What is Oversubscription?

Answer:

It is a situation, when applications for more shares of a company are received than the number offered to the public for subscription.

Question 16.

Write any two limitations of financial statements.

Answer:

- Do not reflect current situation

- Assets many not realize or any other.

Question 17.

State any two uses of financial statement analysis.

Answer:

Uses of financial analysis

- Help the financial manger to take better decision.

- Helps the management is measuring the success of the companies operations or any other.

Question 18.

Mention any two activities which are classified for preparation of cash flow statement as per AS – 3

Answer:

Two activities for the preparation of cash flow statement are :

- Operating activities

- Investing activities or

- Financing activities

Section – C

III. Answer any Four questions, each question carries Six marks : ( 4 × 6 = 24 )

Question 19.

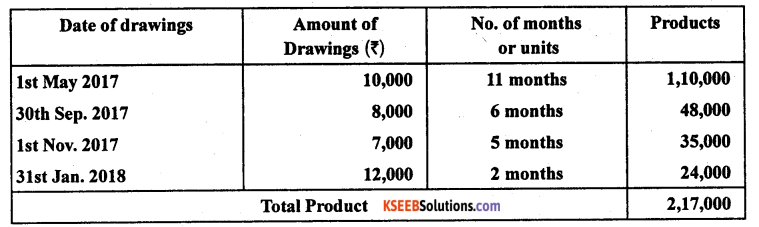

Mahesh, a partner in firm withdrew the following amounts during the year ended March 31,

May 01, 2017 – ₹ 10,000

September 30, 2017 – ₹ 8,000

November 01, 2017 – ₹ 7,000

January 31,2018 – ₹ 12,000

Calculate interest on his drawings at 9% p.a. under product method.

Answer:

Calculation of Interest in Drawings under product month

Interest = Total products x Ratio of interest x \(\frac { 1 }{ 2 }\) = \(2,17,000 \times \frac{9}{100} \times \frac{1}{12}\)

= ₹ 1627.50 or ₹ 1,628

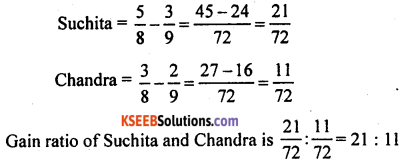

Question 20.

Ankit, Suchit and Chandru are partners in a firm sharing profits and losses in the ratio of 4:3 : 2 Ankit retires from the firm. Suchit and Chandru agreed to share in the ratio of 5 :3 in future. Calculate gaining ratio of suchit and Chandru.

Answer:

O.RS Ratio = Anikita -4 : Suchita – 2 : Chandra – 2

NPSR = Suchita – 5 : Chandra – 3

Share of Gain = New Share – Old share

Question 21.

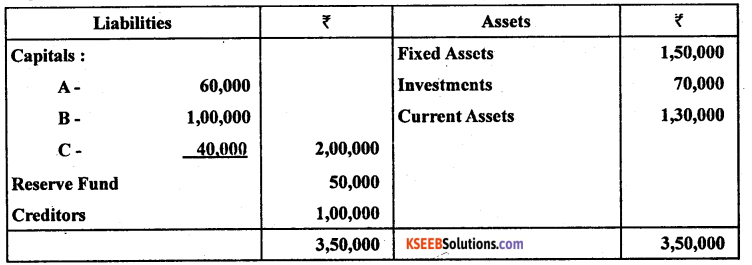

A, B and C are the partners in a business sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Their Balance Sheet as on 31st March 2017 was as follows:

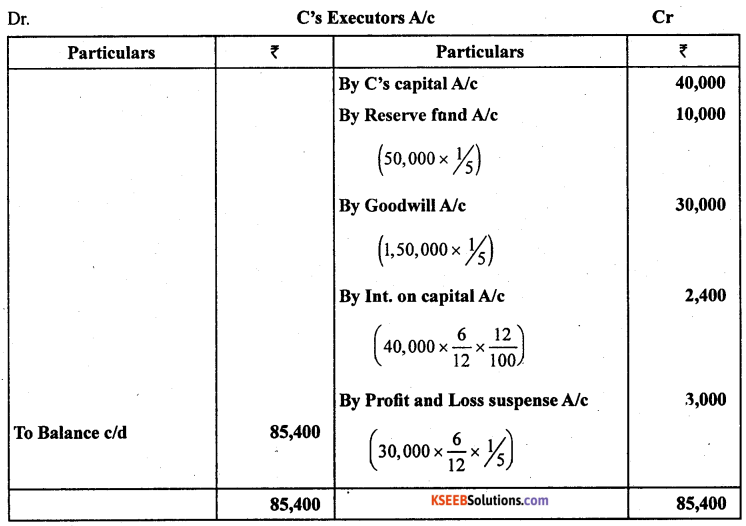

C died on 30 th Sept, 2017. The partnership deed provides the following:

- The deceased partner will be entitled to his share of profit up the date of death calculated on the basis of previous year’s profit.

- He will be entitled to his share cf goodwill of the firm calculated on the basis of three years purchase of average of last four years profit. The profits for last four years arc given below;

2013-14 ₹ 80,000 ; 2014-15 ₹ 50,000; 2015-16 ₹ 40,000 and 2016-17 ₹ 30,000. - Interest on capital is to be allowed at 12% p.a.

Prepare C’s Executors account.

Answer:

![]()

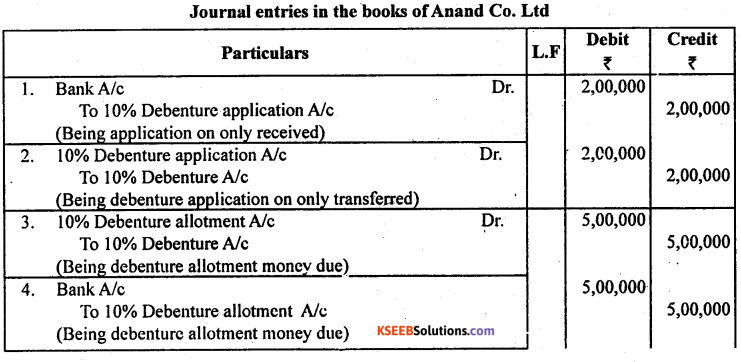

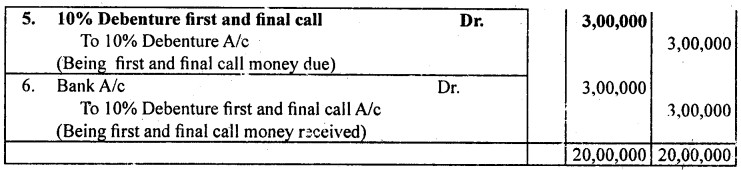

Question 22.

Anand Co., Ltd, issued 10,000,10% debentures at ₹ 100 each payable as :

₹ 20 on application

₹ 50 on allotment and }

₹ 30 on first and final call

All the debentures were subscribed and money duly received.

Pass necessary journal entries.

Answer:

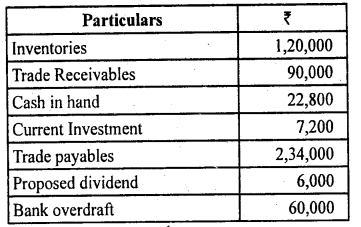

Question 23.

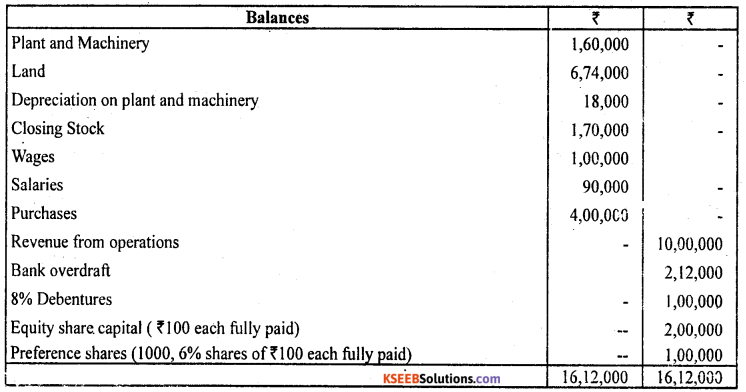

From the following particulars, prepare a statement of profit and loss for the year ending 31st March 2017 as per the schedule III of the companies Act of 2013:

Answer:

Note to Accounts : Employee benefit expenses

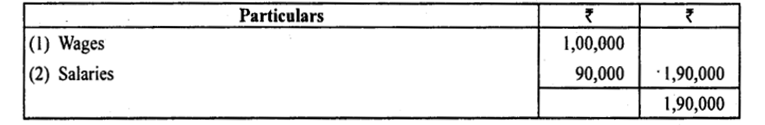

Question 24.

From tbe following particulars, Calculate current ratio and quick ratio:

Answer:

Question 25.

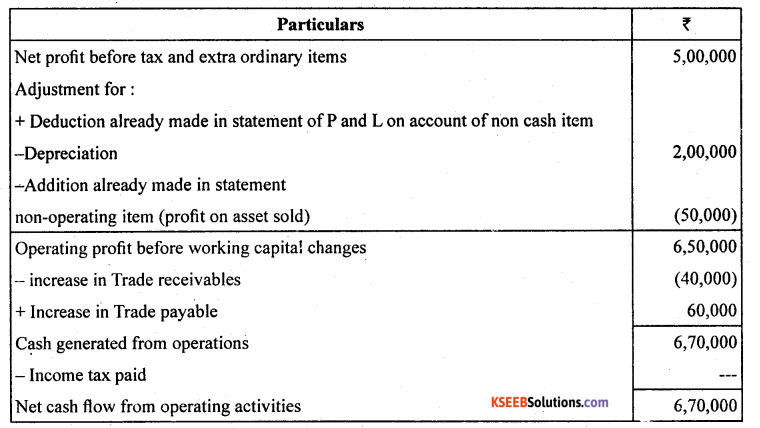

Praful Ltd, arrived at a net income of ₹ 5,00,000 for the year ended March 31,2018. Depreciation for the year was ₹ 2,00,000. There was a profit of ₹ 50,000 on asset sold which was transferred to statement of profit and loss. Trade receivables increased during the year ₹ 40,000 and Trade payables also increased by ₹ 60,000.

Compute the cash flow from operating activities by the indirect method.

Answer:

Cash Flows from operating activities (Indirect method)

Section – D

VI. Answer any Four questions, each question carries Twelve marks : ( 4 × 12 = 48 )

Question 26.

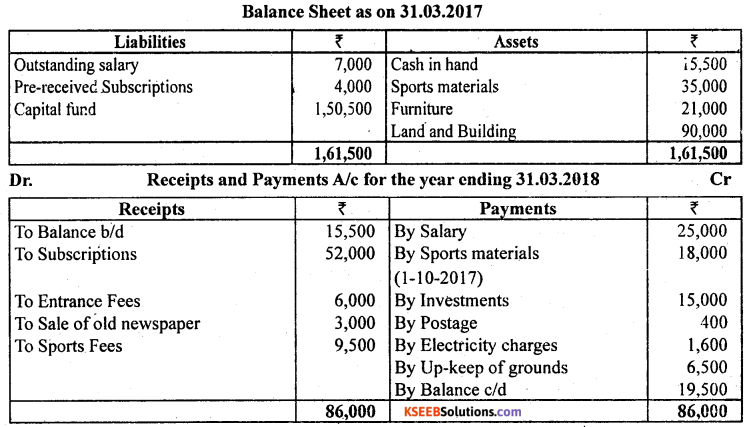

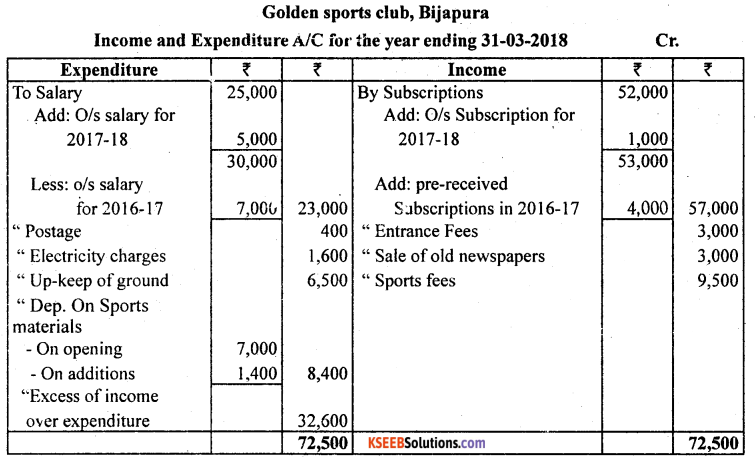

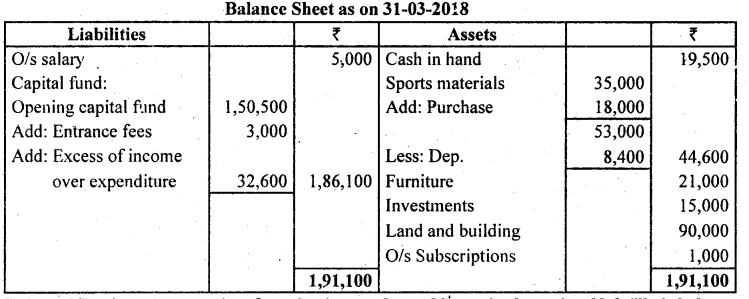

Following are the Balance Sheet and Receipts and Payments Account of Golden Sports Club, Vijayapur:

Adjustments:

(a) Outstanding subscriptions for 2018 ₹ 1,000.

(b) Outstanding salary as on 3 1-03-2018 ₹ 5,OO0

(c) Half of the entrance fees to be capitalised.

(d) Depreciate sports materials @ 20% per annum

Prepare (i) Income and Expenditure account for the year ending 31-03-2018 and (ii) Balance Sheet as on that date.

Answer:

![]()

Question 27.

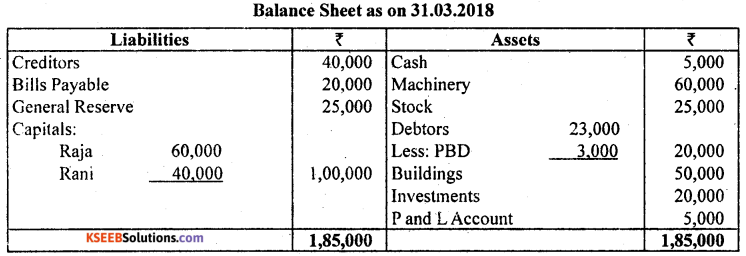

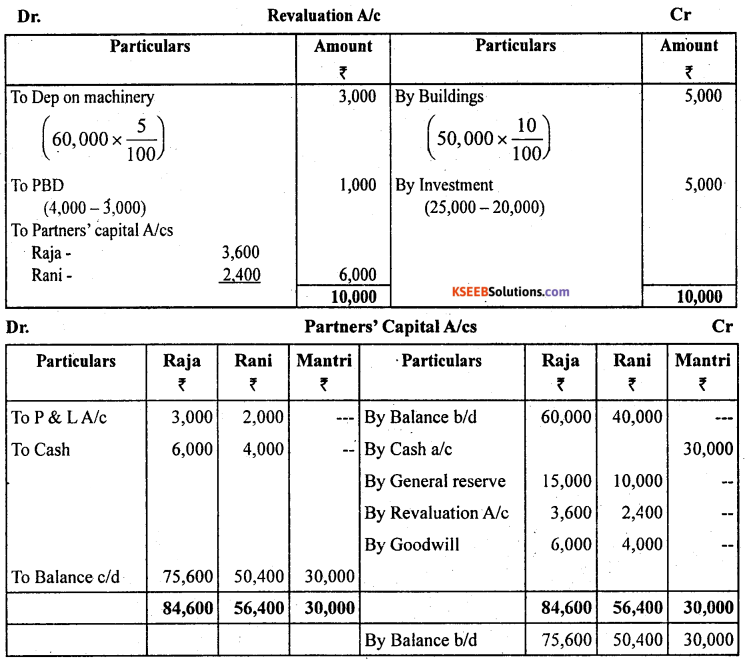

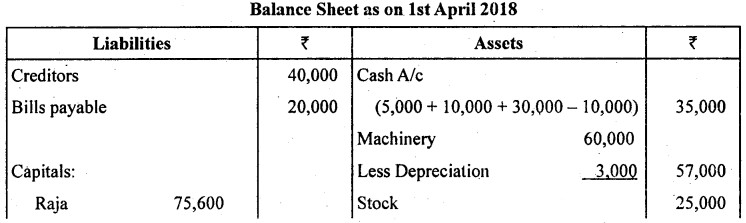

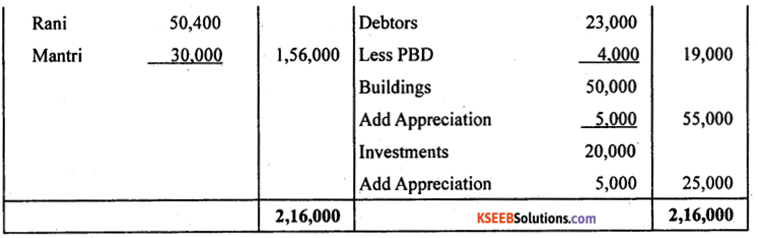

Raja and Rani are partners in a firm sharing profits and losses in the ratio of 3:2. Their balance sheet as on 3 1.03.2018 was as follows:

On 01.04.2018 they admitted Mantri as a partner and offer him 1/5th share in the future profits on the following terms:

a. Mantri has to bring in ₹ 30,000 as his capital and ₹ 10,000 towards goodwill. Goodwill is to be withdrawn by the old partners.

b. Depreciate Machinery by 5%

c. Appreciate buildings by 10%

d. PBD is maintain at 4,000 and Investments are to be revalued at ₹ 25,000

Prepare : (i) Revaluation Account, (ii) Partners Capital Accounts and

(iii) Balance Sheet of the firm after admission.

Answer:

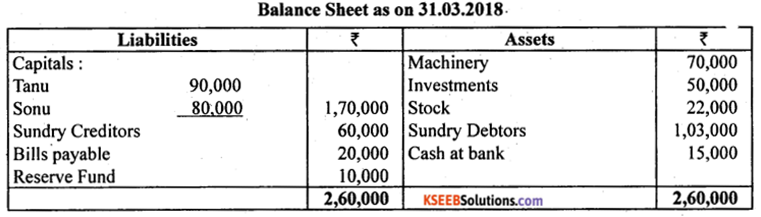

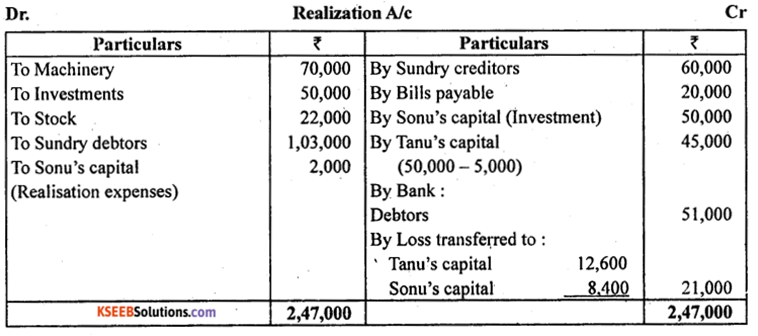

Question 28.

Tanu and Sonu are partners in a firm sharing profits and losses in the ratio of 3 : 2. They decided to dissolve their firm on 31.03.2018. Their Balance Sheet was as follows:

The following information is available :

a. Machinery were given to creditors in full settlement of their account and stock were given to bills payable in full settlement.

b. Investments are taken over by Soqu at book value. Sundry Debtors book value of ₹ 50,000 were taken over by Tanu at 10% less and remaining debtors realised ₹ 51,000.

c. Sonu paid realization expenses of ₹ 1,000 and she was to get a remuneration of ₹ 2,000 for completing the dissolution process.

Prepare:

(a) Realisation A/c }

(b) Partners’ Capital Accounts and

(c) Bank A/c

Answer:

![]()

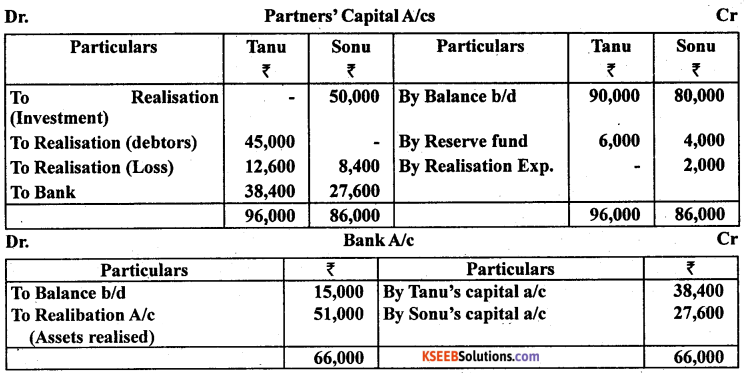

Question 29.

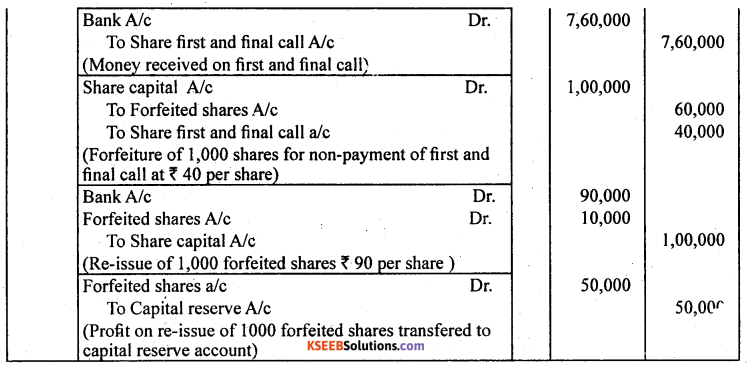

Sun India Ltd., issued 20,000 shares of ₹100 each at a premium of ₹ 10 each. The amount was payable as follows:

₹ 20 on application

₹ 50 on allotment [including premium]

₹ 40 on first and find call.

All the shares were subscribed and money duly received except the first and final call money on 1,000 shares. The directors forfeited these shares and re-issued them as fully paid @ ₹ 90 per share.

Pass the journal entries relating to issue, forfeiture and re-issue of shares in the books of the company.

Answer:

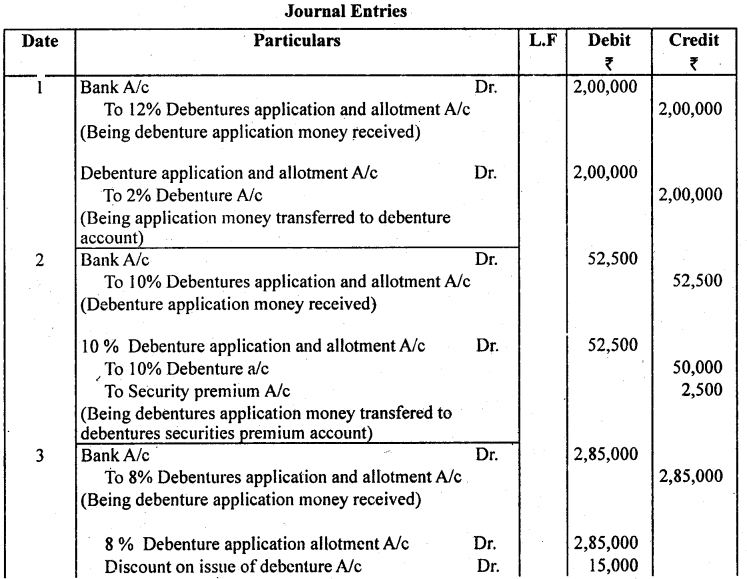

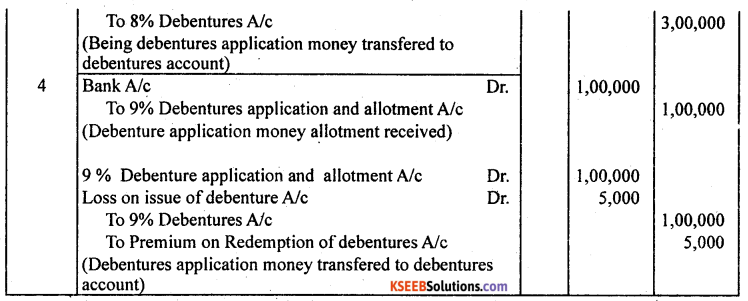

Question 30.

Give journal entries for the following:

a. Issue of ₹ 2,00,000 12% debentures of ₹ 100 each at par and redeemable at par.

b. Issue of ₹ 50,000,10% debentures of ₹ 100 each at a premium of 5% but redeemable at par.

c. Issue of ₹ 3,00,000,8% debentures of ₹ 100 each at a discount of 5% repayable at par.

d. Issue of ₹ 100,000, 9% debentures of ₹ 100 each at par but repayable at a premium of 5%.

Answer:

In the Books of Company

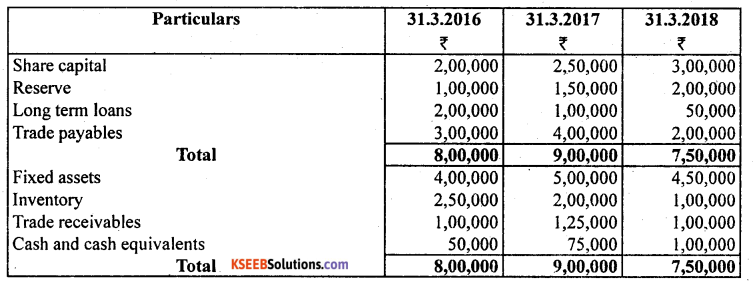

Question 31.

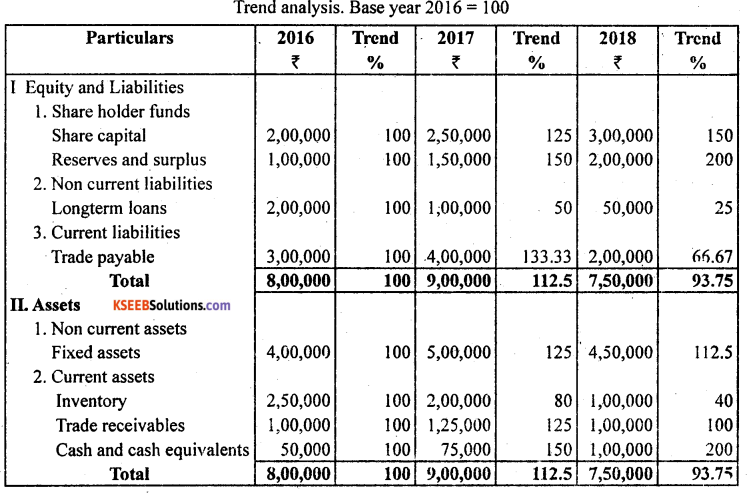

From the following balance sheets of LG Industries Ltd., compute the Trend percentages using 31.3.2016 as base year.

Answer:

Question 32.

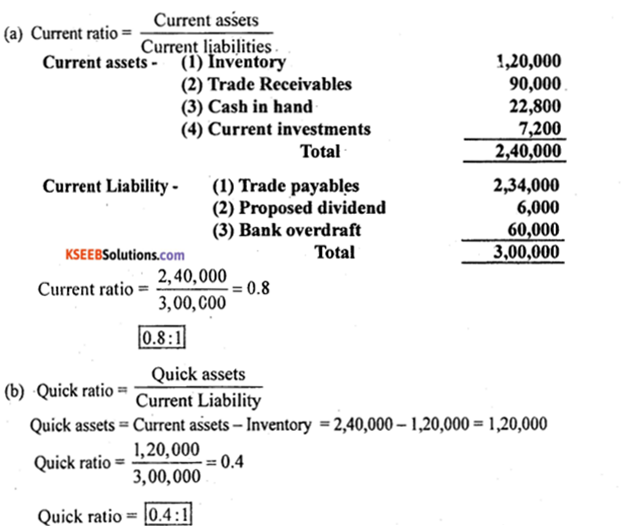

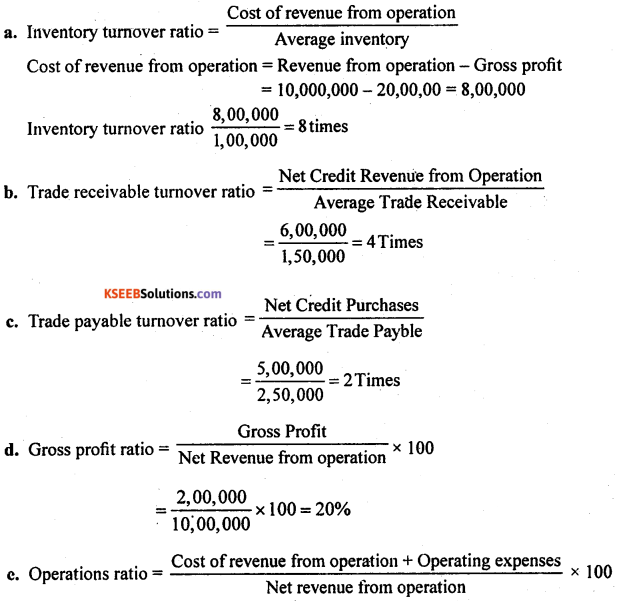

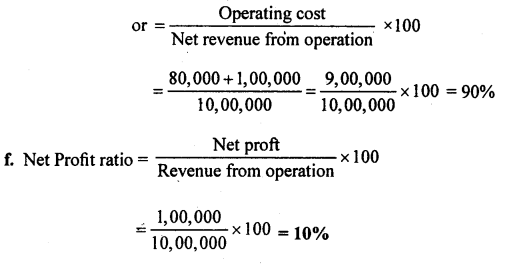

From the following particulars calculate :

a. Inventory turnover ratio

b. Trade receivable turnover ratio

c. Trade payable turnover ratio

d. Gross profit ratio

e. Operating ratio

f. Net Profit ratio

| Particulars | ₹ |

| Revenue from operations | 10,00,000 |

| Gross profit | 2,00,000 |

| Average inventory | 1,00,000 |

| Net credit revenue from operations | 6,00,000 |

| Average Trade Receivables | 1,50,000 |

| Net Credit Purchases | 5,00,000 |

| Average Trade payables | 2,50,000 |

| Operating expenses | 1,00,000 |

| Net profit | 1,00,000 |

Answer:

From the following particulars calculate :

![]()

Section – E

(Practical Oriented Questions)

V. Answer any Two questions, each question carries Five marks: ( 2 × 5= 10 )

Question 33.

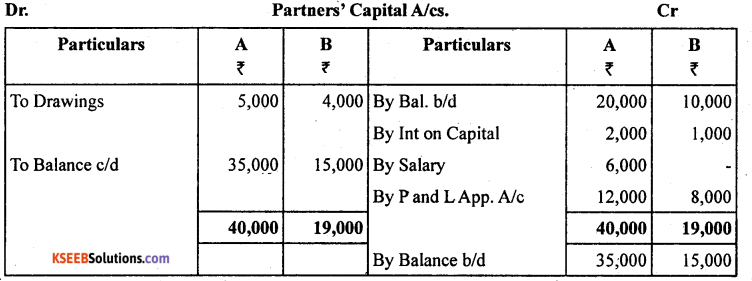

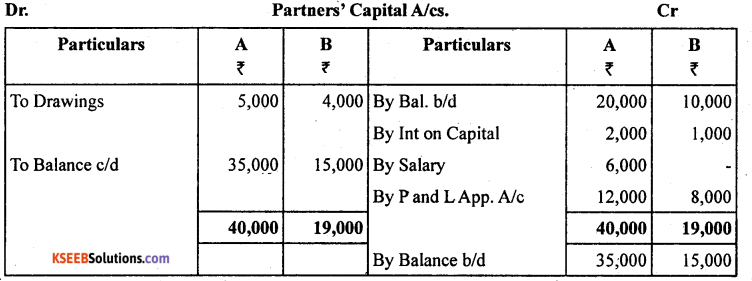

Write two partners capital accounts under fluctuating capital system with 5 imaginary figure.

Answer:

Question 34.

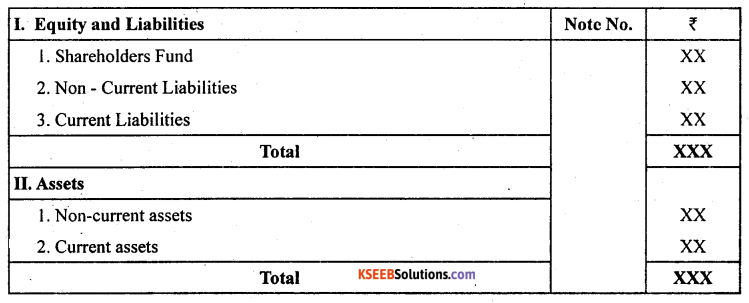

Write proforma of Balance Sheet of a company with main heads only.

Answer:

Balance Sheet as at 31 st March 20

Question 35.

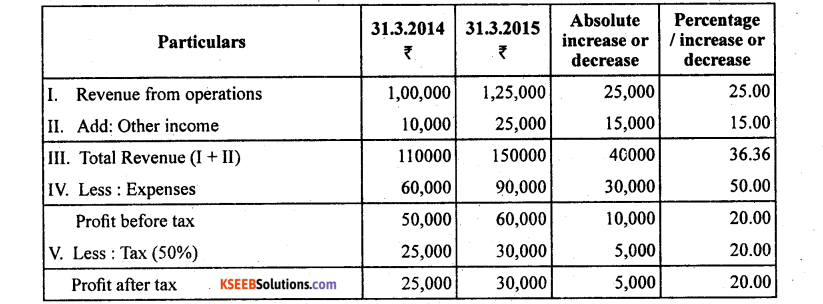

Prepare comparative income statement of profit and loss with five imaginary figures

Answer:

Comparative Statement of profit and loss for the year ended March 31, 2014 and 2015.