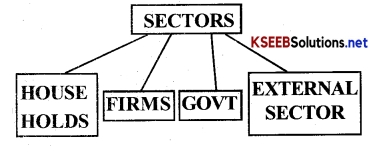

Karnataka 2nd PUC Economics Important Questions Chapter 6 Open Economy Macroeconomics

Very Short Answer Type Questions

Question 1.

What do you mean by open economy?

Answer:

An economy which has economic rela¬tions with other countries of the world with regard to good and services, financial assests. etc.

Question 2.

Give the meaning of foreign trade?

Answer:

Foreign trade refers to trade betwee different countries.

Question 3.

What is meant by balance of trade?

Answer:

Balance of trade refers to Difference between the value of visible items of exports and imports during a year.

Question 4.

State the meaning of exchange rate?

Answer:

An exchange rate is the rate at which one curency is converted into another.

![]()

Question 5.

What do you mean by closed economy?

Answer:

An economy that does not interact with the economy of any other country is called as closed economy.

Question 6.

Expand BOP?

Answer:

BOP – Balance of Payments.

Question 7.

What is trade?

Answer:

The term trade refers to exchange of goods and services between two individuals or nations.

Question 8.

What do you understand by flexible exchange rate?

Answer:

Flexible exchange rate is a system in which exchange rate keeps on changing or floating.

Short Answer Type Questions

Question 1.

Distinguish between closed economy and open economy?

Answer:

Closed economy

- A closed economy is an economy that does’nt interact with other countries economies.

- Closed economy prohibits import and export.

- Closed economy follows restricted trade policies.

Open economy

- An open economy is an economy which has economic relations with other countries economies.

- Open economy engages in import and export.

- Open economy follows free trade policies.

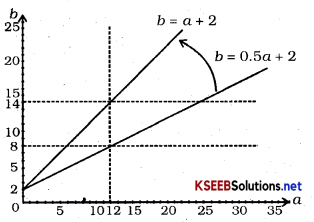

![]()

Question 2.

What do you mean by unilateral trade?

Answer:

Unilateral trade can be defined as trade that is imposed on one nation by the other nation, benefiting the later which is usally, is a developed country.

ex: India has unilateral trade agreement with England prior to Independence.

Question 3.

What do you mean by bilateral trade?

Answer:

Bilateral trade means the system of trading exclusively between two countries or two groups of countries, for their mutual advantage.

ex: Indo-Srilankan free trade agreement.

Question 4.

Name the three important accounts of Balance of payments?

Answer:

The three important accounts of BOP are:

- current account

- capital account

- official account

Question 5.

State the meaning of official Reserve Account?

Answer:

The official reserve account of a country indicates change in a country’s reserve assets during a year. It is in the form of foreign currencies, gold and special drawing rights.

Question 6.

What do you mean by multilateral trade?

Answer:

It refers to involvement of three or more groups of countries in trade. Trade is regulated between the nations without discrimination.

Question 7.

What are the differences between balance of trade and balance of payments?

Answer:

Balance of trade:

- Balance of trade refers to the difference between the value of visible items of exports and imports during a year.

- Balance of trade is narrow concept.

- The Balance of trade is only a partial study of the BOP.

Balance of Payments:

- Balance of payments is the difference between the value of visible and invisible items of exports and imports.

- Balance of Payments is Broader concept.

- Balance payments give a complete picture of a country’s international economic transactions.

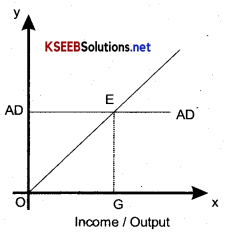

![]()

Question 8.

Distinguish between nominal and real exchange Rates?

Answer:

Nominal exchange rate:

- When the exchange rate is quoted in terms of money it is called as nominal exchange rate.

- The nominal exchange rate, means, the amount of domestic currency paid to purchase one unit of foreign currency.

Real exchange rate

- Real exchange is the ratio of foreign prices to domestic prices measured in the same currency.

- The real exchange rate means, the relative price of foreign goods in terms of domestic goods.

Question 9.

What is fixed exchange rate?

Answer:

An exchange rate between the currencies of two or more countries is fixed more by the monetary authority at a particular level.

Long Answer Type Questions

Question 1.

Explain the structure of balance of payments?

Answer:

The structure of balance of payments includes three main accounts:

- Current Account

- Capital Account

- Official Reserve Account

- Current Account

Current Account of Balance of payments deals with exports and imports of goods and services and transfer payments.

Current account consists of three sub groups:

- Trade account or export and import of commodities.

- Invisible account or services rendered and received.

- transfer of payments.

Capital Account:

Capital Account deals with payments of debts and claims. It includes capital transactions such as

- Borrowing and lending loans,

- Repayments of loans,

- And sale and purchase of assets from foreign countries.

Official Account:

If a country receives an excess of foreign exchange than the foreign exchange expenditure it results in surplus.

Question 2.

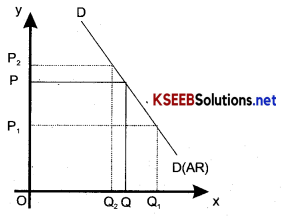

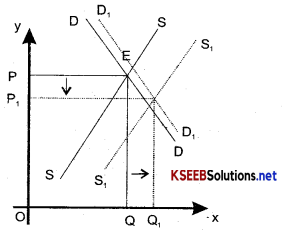

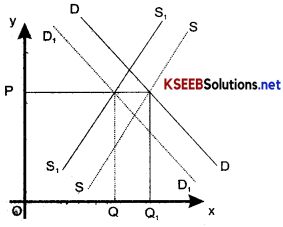

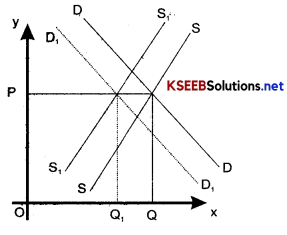

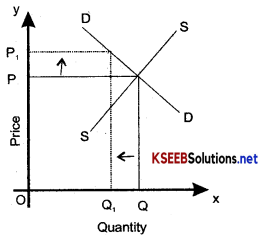

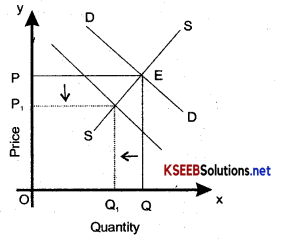

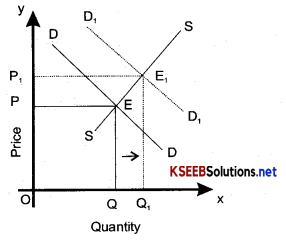

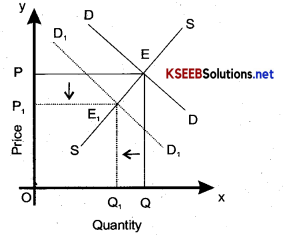

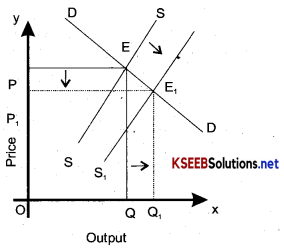

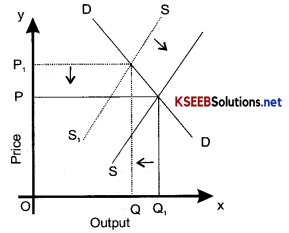

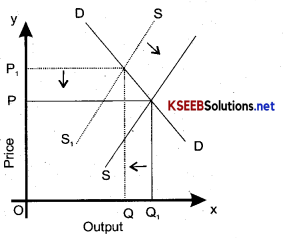

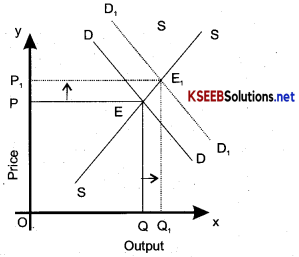

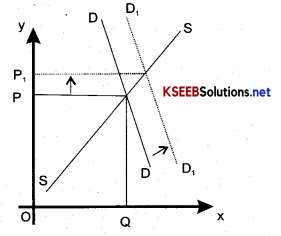

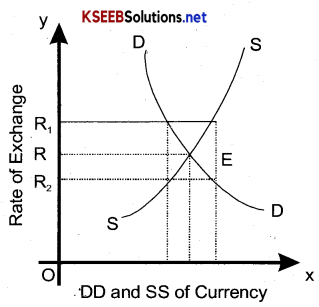

Explain the theories of determination of exchange rate?

Answer:

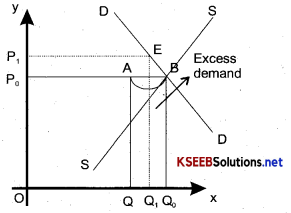

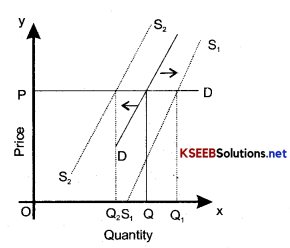

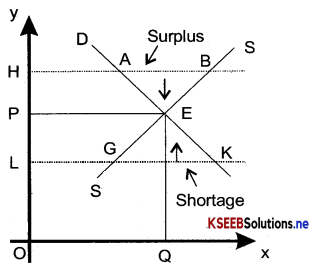

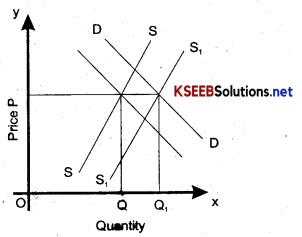

There are two important theories which of any commodity is determined by the free play of the forces of demand and supply.

![]()

Question 3.

What are the exchange rate systems?

Answer:

There are three important exchange rate systems, namely

- Flexible Exchange Rate.

- Fixed Exchange Rate.

- Managed Exchange Rate.

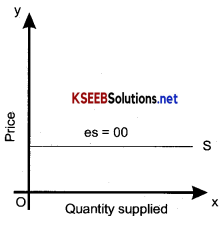

Flexible exchange Rate:

A flexible exchange rate is a system in which exchange rate keeps on changing or floating. In this system exchange rate is determined by the market forces of demand and supply.

Fixed exchange Rate:

Under the fixed exchange rate the exchange rate is fixed by the monetary authority. In this case, the exchange rate is fixed at a particular level.

Managed floating Rate:

Managed floating system is a mixture of flexible and fixed exchange rate systems. Under this system exchange rate is fixed by the market forces.

Question 4.

Give the meaning of the balance of payments and explain its structure?

Answer:

Balance of payments is the difference between the value of visible and invisible items of exports and imports. In other words Balance of payments is a statement of systematic record of all economic transactions between one country and the rest of the world during a year.

It shows what is sent to foreign countries by nations and what is received by them in return. Balance of payment shows the International economic position of the country in making decisions of monetary and fiscal policies, foreign trade, foreign exchange and international payments to the government authorities for structure ofBalance ofpayments

The structure of balance of payments includes three main accounts:

- Current Account

- Capital Account

- Official Reserve Account

Current Account:

Current Account ofBalance ofpayments deals with exports and imports of goods and se rvices and transfer payments.

The current account consists of three sub groups:

- Trade account or export and import of commodities.

- Invisible account or services rendered and received.

- Transfer of payments.

Capital Account: Capital Account deals with payments of debts and claims. It includes capital transactions such as

- Borrowing and lending loans,

- Repayments of loans,

- And sale and purchase of assets from foreign countries.

Official Account:

If a country receives excess of foreign exchange than the foreign exchange expenditure it results in surplus.

Exercises

Question 1.

Differentiate between balance of trade and current account balance

Answer:

The balance of exports and imports of goods is referred as the balance of trade. Adding trade in services and net transfers to the trade balance, we get the current account balance = Trade balance (Balance of Trade) + Trade in services and net transfers.

Question 2.

What are official reserve transa ctions? Explain their importance in the balance of payments.

Answer:

The transactions carried by monetary authority of a country, which cause changes in official reserves, are termed as official reserve transactions (ORT). These transactions are carried through purchase or sale of currency in the exchange market for foreign currencies or other assets. The reserves are drawn by selling foreign currencies in exchange market during deficits and foreign currencies are purchased during surplus. When the official reserves increases or decreases, it is called overall balance of payments surplus or deficit respectively.

Importance of ORT in balance of payments:

- Purchase of a country’s own currency is a credit item in the balance of payments; whereas, sale of the-currency is a debit item

- It helps to adjust the deficit and surplus in ‘ balance of payments. ,

![]()

Question 3.

Distinguish between the nominal exchange rate and the real exchange rate.

Answer:

If you were to decide whether to buy domestic goods or foreign goods, which rate would be more relevant? Explain.

Nominal exchange rate is the price of one currency in terms of another. It is the amount of domestic currency required to buy one unit of foreign currency. For example, a rupee- do liar exchange rate of Rs 45 means that it costs 45 rupees to buy 1 dollar.

Real exchange rate is the ratio of foreign prices to domestic prices. In other words, it measures foreign prices relative to domestic prices.

Real exchange rate = e\(\frac{\mathrm{P}_{\mathrm{f}}}{\mathrm{P}}\)

Where Pf- price level of foreign currency P – Price level of domestic currency For example, if a watch costs $ 40 in the US and the nominal exchange rate is 50 per US dollar, then, with real exchange rate of 1 Dollar it should cost Rs. 2,000 (ePf = 50 × 40 = Rs 2000) in India.

If I was to decide whether to buy domestic goods or foreign goods, then real exchange rate will be more relevant, because real exchange rate takes the inflation differential among the countries into account and is also used as an indicator of a country’s competitiveness in the foreign trade.

Question 4.

Suppose it takes 1.25 yen to buy a rupee, and the price level in Japan is 3 and the price level in India is 1.2. Calculate the real exchange rate between India and Japan (the price of Japanese goods in terms of Indian goods). (Hint: First find out the nominal exchange rate as a price of yen in rupees).

Answer:

Price level in foreign country: (Japan) Pf= 3

Price level in home country: (India)

P = 1.2

Now, real exchange rate = e\(\frac{\mathrm{P}_{\mathrm{f}}}{\mathrm{P}}\)

Price of 1.25 yen = 1 rupee

Price of 1 yen = \(\frac{1}{1.25}=\frac{100}{125}=\frac{4}{5}\) rupee

Therefore, e = \(\frac{1}{1.25}=\frac{100}{125}=\frac{4}{5}\)

So, real exchange rate = e\(\frac{\mathrm{P}_{\mathrm{f}}}{\mathrm{P}}\)

= \(\frac{4}{5} \times \frac{30}{1.2}\) = 2

Therefore, the real exchange rate is 2.

Question 5.

Explain the automatic mechanism by which BoP equilibrium was achieved under the gold standard.

Answer:

Under the gold standard, adjustment to BOP surpluses or deficits cannot be brought about through changes in the exchange rates.

The adjustment must either come about automatically through the working of the economic system or be brought about by the government. Under the gold standard system, all the currencies were defined in terms of gold. Each participant country committed to guaranteeing the free convertibility of its currency into gold. Each participant country committed to guaranteeing the free convertibility of its currency into gold at a fixed price into another asset (gold) acceptable in international payments. This also made it possible for each currency to be convertible into all others at a fixed price. Exchange rates were open economy. Macroeconomics is determined by its worth in terms of gold ( where currency was trade) of gold its actual gold content).

For example, if one unit of saying currency A was worth one gram of gold, or one unit of currency B was worth two grams of gold, currency B would be worth twice as much as currency A without having to first buy gold and then sell it. The rates would fluctuate between an upper and a lower limit. These limits being set by the costs of melting, shipping, and recovering between the two countries. To maintain the official parity, each country needed an adequate stock of gold reserves. All countries on the gold standard have stable exchange rates. Thus fixed rates were maintained by an automatic equilibrium mechanism

![]()

Question 6.

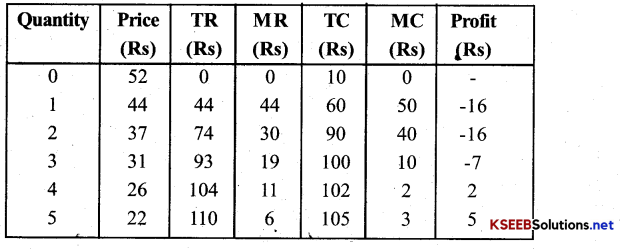

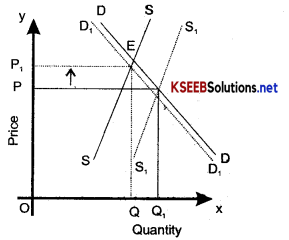

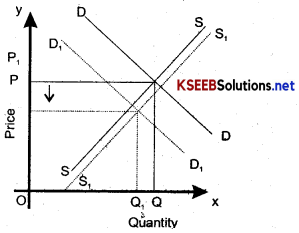

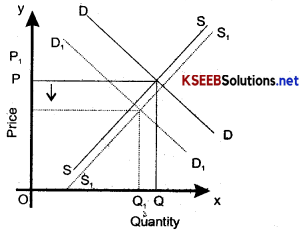

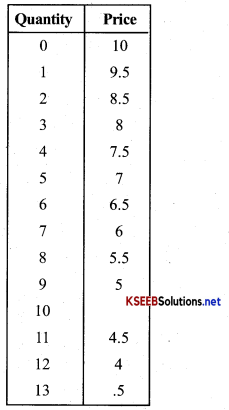

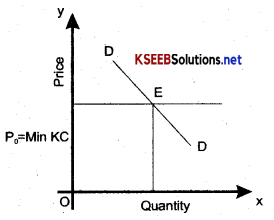

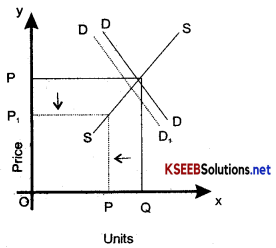

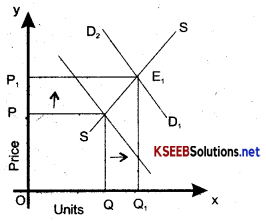

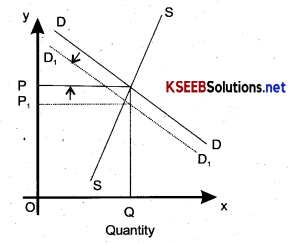

How is the exchange rate determined under a flexible exchange rate regime?

Answer:

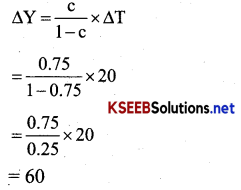

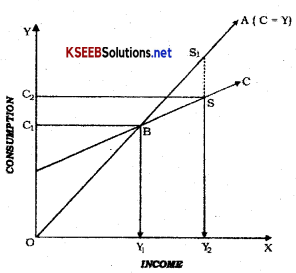

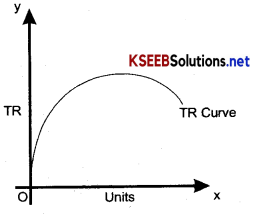

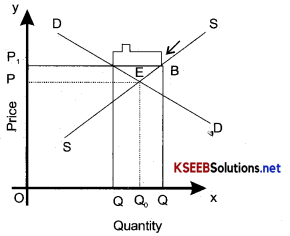

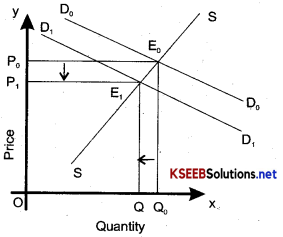

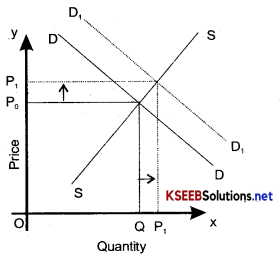

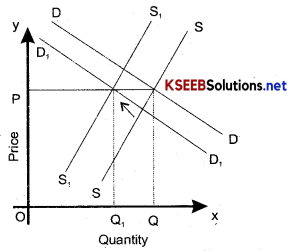

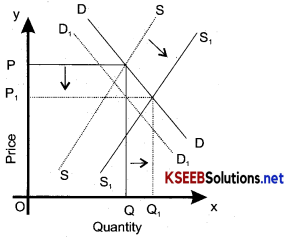

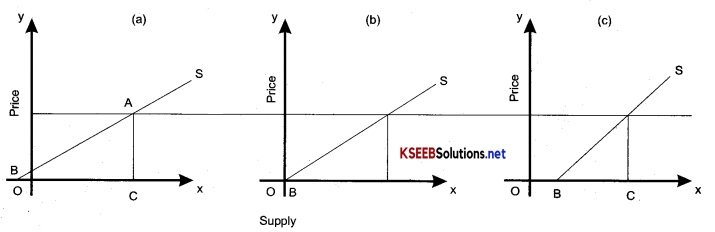

Under a flexible exchange rate regime, the rate of exchange is determined by the forces of demand and supply. In other words, the equilibrium rate of exchange occurs where demand and supply are equal to each other. This can be illustrated with the help of the given figure:

In the figure, the x-axis represents demand for and supply of foreign currency andy-axis represents the exchange rate. DD is the demand curve that is downward sloping, showing an inverse relationship between the rate of exchange and demand for foreign currency. Whereas, the supply curve is upward sloping, showing a positive relationship between the rate of exchange and the supply of foreign currency. E is the equilibrium rate of exchange, where the demand equates to the supply of foreign exchange (OR). Now, if the exchange rate rises to OR1, then the supply exceeds the demand, forcing the exchange rate to fall back to OR. On the contrary, if the exchange rate falls to OR2, there is excess demand oversupply.

Hence, the rate of exchange rises from R2 to R. Hence, the equilibrium exchange rate (OR) is determined by demand and supply of foreign currency.

Question 7.

Differentiate between devaluation and depreciation.

Answer:

| Devaluation | Depreciation |

| 1. It occurs when the currency exchange rate is officially lowered under fixed exchange rate system. | 1. When the value of currency falls as compared to other currencies, it is known as depreciation. |

| 2. It exists under a fixed exchange rate. | 2. It exists under a flexible exchange rate. |

| 3. It is due to the government’s decision | 3. It is due to the demand and supply forces. |

Question 8.

Would the central bank need to intervene in a managed floating system? Explain

Answer:

Managed floating system is a combination of two systems fixed and floating exchange rate systems. It calls for the government or central bank to intervene when the need for the same is needed. The government or the central bank helps in moderating the exchange rate movements by purchasing and selling of foreign currency. Thus, to avoid dirty floating, the government exercises its power to intervene, whenever the need arises.

Question 9.

Are the concepts of demand for domestic goods and domestic demand for goods the same?

Answer:

In a closed economy, the demand for domestic goods and domestic demand for goods are similar terms. However, in an open economy, these two terms have different meanings. Demand for domestic goods includes both domestic and foreign demand for domestic goods. Whereas domestic demand for goods refers to the domestic market demand of a country, that is either produced domestically or abroad (foreign countries).

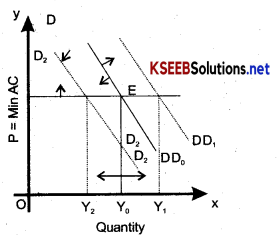

Question 10.

What is the marginal propensity to import when M = 60 + 0.06Y? What is the relationship between the marginal propensity to import and the aggregate demand function?

Answer:

Marginal propensity to import is the fraction of additional income spent on imports. It is given that M = 60 + 0.06Y Therefore, marginal propensity to import (m) = 0.06. It reflects induced imports; that is the part of the total imports, which is a function of income.

Since the marginal propensity to import negatively affects the aggregate demand function, when income increases the aggregate demand decreases. This is because the additional income is spent on foreign goods and not on domestic products.

Question 11.

Why is the open economy autonomous expenditure multiplier smaller than the closed economy one?

Answer:

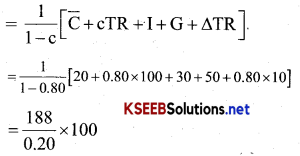

In case of a closed economy, equilibrium level ofineome is given by

Y = C + cY + I + G

Or, Y – c Y = C +1 + G

Or, Y (1 – c) = C + I + G

Or,Let, (C + I + G) = A1

Or, Y = \(\frac{\mathrm{A}_{1}}{1-\mathrm{c}}\) ………………(1)

Or, \(\frac{\Delta \mathrm{Y}}{\Delta \mathrm{A}_{1}}=\frac{1}{1-\mathrm{c}}\)

In the case of an open economy, equilibrium level ofineome is given by

Y = C + cY + I + G + X- M- mY

Or, Y – c Y – mY = C + I + G + X

Or, Y (1 – c – m) = C + I + G + X

Or, Y = \(\frac{\mathrm{C}+\mathrm{I}+\mathrm{G}+\mathrm{X}}{1-\mathrm{c}-\mathrm{m}}\)

Let autonomous expenditure (A2) = C + I + G + X

Or, Y = \frac{\mathrm{A}_{2}}{1-\mathrm{c}-\mathrm{m}}

\(\frac{\Delta Y}{\Delta A_{2}}=\frac{1}{1-c-m}\) ………………………(2)

Comparing equations (1) and (2) and the denominators of the two multipliers, we can conclude that the multiplier in an open economy is smaller than that in a closed economy, as the denominator in an open economy is greater than the denominator in a closed economy.

Question 12.

Calculate the open economy multiplier with proportional taxes, T = tY, instead of lump-sum taxes as assumed in the text.

Answer:

In the case of proportional tax, the equilibrium income would be

Y = C+c (1 -1) Y+1 + G + X – M – mY

Y – c(1 – t)Y + mY = C + 1 + G + X – M

Y[1 – c(1 – t) + m] = C + I + G + X – M

Y = \(\frac{C+I+G+X-M}{1-c(1-Y)+m}\)

Autonomous expenditure (A) = C + I + G + X – M

Therefore, open economy multiplier with proportional taxes

\(\frac{\Delta Y}{\Delta A}=\frac{1}{1-c(1-t)+m}\)

Question 13.

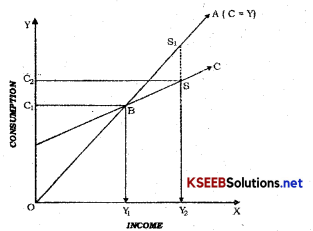

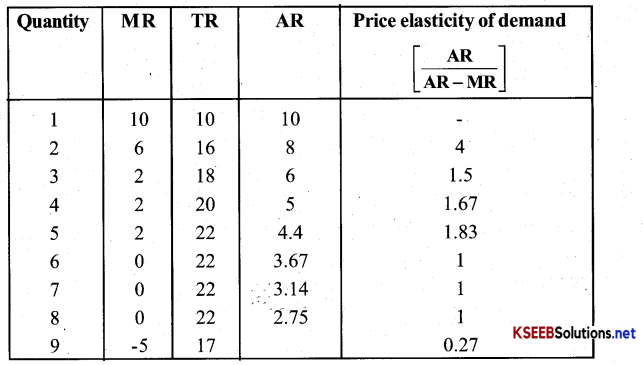

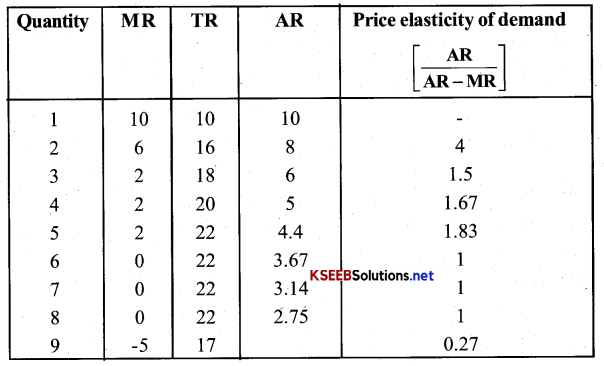

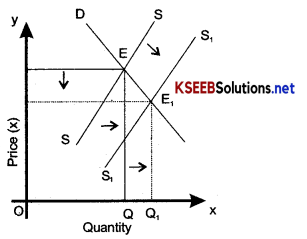

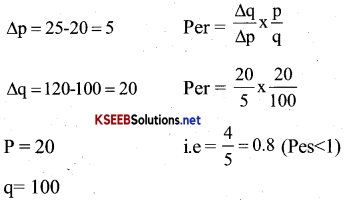

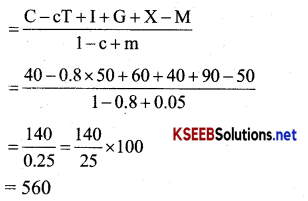

Suppose C = 40 + 0.8Y D. T = 50,1 = 60, G = 40, X = 90, M = 50 + 0.05Y

(a) Find equilibrium income

(b) Find the net export balance at equilibrium income

(c) What happens to equilibrium income and the net export balance when the government purchases increase from 40 to 50?

Answer:

C = 40 + 0.8YD 4

T = 50

I = 60

G = 40

X = 90

M = 50 + 0.05Y

(a) Equilibrium level of income

Y = C + c(Y – T) + I + G + X – M – mY

Y = \(\frac{\mathrm{A}}{1-\mathrm{c}+\mathrm{m}}\)

Where, A= C – CT + I + G + X – M

(b) Net exports at equilibrium income

NX = X – M – mY

= 90 – 50 – 0.05 × 560 = 40 – 28 = 12

(c) When G increase from 40 to 50, Equilibrium income

Net export balance at equilibrium income

NX = X – (M – mY)

= 90 – 50 + 0.05 × 600 = 40 – 30 = 10

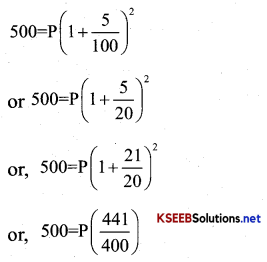

![]()

Question 14.

In the above example, if exports change to X = 100, find the change in equilibrium income and the net export balance.

Answer:

C = 40 + 0.8 YD

T = 50

I = 60

G = 40

X= 100

M = 50 + 0.05Y

Net export balance NX = X – M – 0.05Y

= 100 – 50 – 0.05 × 600

= 50 – 0.05 × 60

= 50 – 30 = 20

Question 15.

Explain why G -T = (Sg – I) – (X – M).

Answer:

In a closed economy, savings and investments are equal at the equilibrium level of income. However, in open economy savings and investments differ.

Y = C + I + G + X – M

Or, Y = C + I + G + NX [As NX = X – M]

Or, Y – C – G = I + NX

Or, S = I + NX

Savings in an economy include private savings (Sp) and government savings (Sg).

So, Sp + Sg = I + NX

Or, NX = Sp + Sg – I

Or, NX = (Y- C – T) + (T – G) – I

Or, NX = Y – C – T + T – G – I [ Sp = Y – C – T][Sg = T – G]

Or, NX = Y – C – G – I

Or, G = Y- C – I – NX

Or, G – T = Y – C – I – NX – T

[Subtracting T from both sides]

Or, G – T = Y – C – T – I – NX

Or, G – T = (Sp – I) – NX

Or, G – T = (Sg – I) – (X – M) [NX = X – M]

Question 16.

If inflation is higher in country A than in country B, and the exchange rate between the two countries is fixed, what is likely to happen to the trade balance between the two countries?

Answer:

Country A has higher inflation than country B. Since, the exchange rate is fixed, it is advantageous for country B to export goods to country A. Similarly, it is advantageous for country A to import goods from country B. On the other hand, it would be expensive for country Ato export goods to country B. Thus, country A will have trade deficit as it will import more goods as compared to exports, from country B. Country B will import less goods as compared to exports, from country A. Hence, there is a trade surplus in country B.

Question 17.

Should a current account deficit be a cause for alarm? Explain.

Answer:

Current account deficit is the excess of total imports of goods, services and transfers over total exports of goods, services and transfers. This situation makes a country debtor to the rest of the world. But, this cannot be always treated as a cause for alarm because countries might be running in deficits (current account) to increase productivity and exports in future. Also, more investment wifi help in building capital stock, which in future will lead to rise in output.

Question 18.

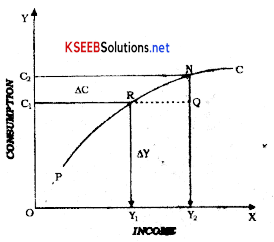

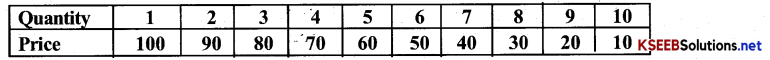

Suppose C = 100 + 0.75YD, I = 500, G = 750, taxes are 20 per cent of income, X = 150, M = 100 + 0.2F. Calculate equilibrium income, the budget deficit or surplus and the trade deficit or surplus.

Answer:

C = 100 + 0.75YD

I = 500 G = 750

X = 150

M = 100 + 0.2Y

Equilibrium income (Y) = C + c (Y – T) + I + G + X – M – mY

Or, Y = 100 + 75 + 750 + 150 – 100 – 0.2 Y

Government expenditure = 750 Government receipts (taxes) = 466.6

Since, government expenditure > government receipts

It shows the government is running budget deficit

NX = X – M – MY

= 150 – 100 – 466.66

= 150 – 566.66

= 416.66

Since NX is negative, it implies trade deficit.

![]()

Question 19.

Discuss some of the exchange rate arrangements that countries have entered into to bring about stability in their external accounts.

Answer:

To combine the two extreme positions, ‘fixed’ and ‘flexible’, the following exchange rate arrangements are used by governments to bring stability in external accounts:

1. Wider Bands: A system that allows adjustment in fixed exchange rate is referred to as wider bands. It permits only 10% variation between the currencies of any two countries. For example, a country can improve its balance of payments (BoP) deficit by depreciating its currency, which leads to increase in demand for domestic goods due to an increase in purchasing power of other currencies. This further leads to the increase in exports, hence inproving the BoP.

2. Crawling Peg: Crawling peg system allows continuous and regular adjustments in the exchange rate. Only 1% of variation is allowed at a time.

3. Managed to float: Managed floating is a scheme under which government can intervene to vary the exchange rate when the situation demands so. There is no specific limit of variation as in crawling peg and wider bands.